Q1

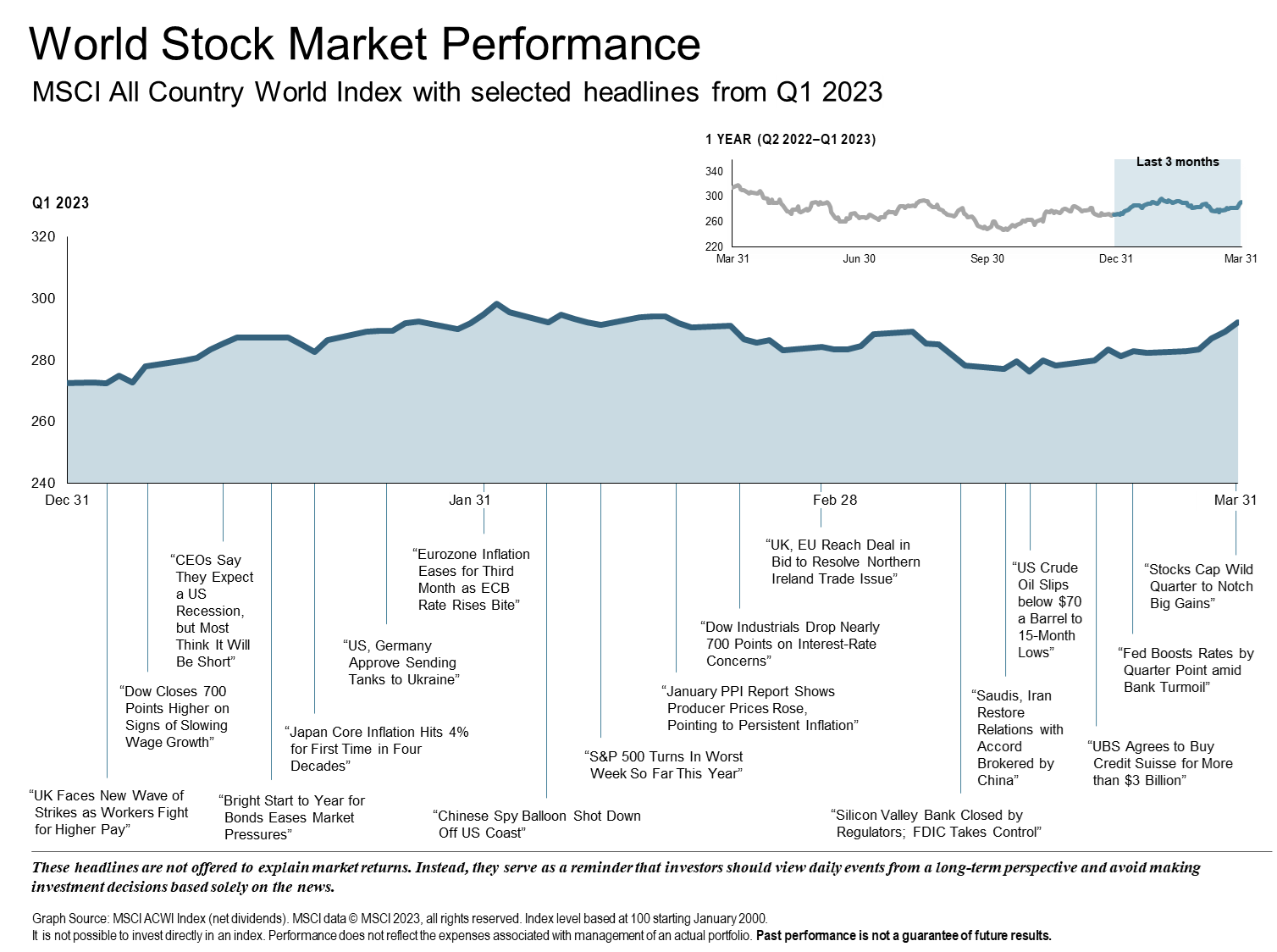

Volatility continued during the first quarter of the calendar year with inflation concerns, the ongoing Russia-Ukraine war, and the collapse of Silicon Valley Bank all factoring into market uncertainties. Despite volatility, the U.S. Stock Market, International Developed Stocks, Emerging Markets, and Bond Markets all experienced gains for the quarter. Monetary policy tightening began a year ago and has continued with additional rate increases by the Fed in February and March. These increases are the result of the U.S. economy remaining more resilient to rising rates than originally anticipated. Recently, the Federal Reserve indicated that the possibility of a recession sometime this year is “plausible”.

Global Economy

Many global economies faced headwinds due to inflationary pressures and tightening monetary and financial conditions. Central banks continued to raise rates in response to inflation, but responses varied. Many emerging markets appear to be at the end of their hiking cycle, while developed markets kept policy rates below trailing inflation rates. China’s economy is accelerating amid a post-COVID reopening and falling energy prices have helped to stabilize Europe.

- Developed markets outside of the U.S. outperformed U.S. equity markets

- International Developed Stocks increased 8.02%

- Emerging Markets increased 3.96%

U.S. Economy

The U.S. equity markets posted positive returns for the first quarter. The S&P 500 increased by 7.5%, which was the best 1st quarter return since 2019 and the second best over the last 10 years. Despite the rebound, the S&P is still in bear market territory. Historically, bear markets have occurred once every 7 years and usually take 17 months to reach bottom. Inflation remains well above the Federal Reserve’s 2% target with higher interest rates expected to continue. As supply constraints are alleviated and demand decreases due to the Fed’s rate increases, inflation should begin to return to normal. Economists’ predictions on timing vary, with some anticipating a return to normal by the end of 2023. Equity market sectors experienced a substantial reversal during Q1 with last years’ laggards becoming the leaders and vice versa. The three worst performing sectors of 2022 (technology, communication services, and consumer discretionary) all experienced double digit returns while the best performing sector (energy) finishing second worst for the quarter.

Equity Markets

- U.S. stock market increased 7.18%

- Value underperformed growth

- Small caps underperformed large caps

Fixed Income

- Bloomberg Barclays US Aggregate Bond Index increased by 3.0%

- Treasury yields declined, but curve is still inverted with both 3-month and 2-year higher than 10-year yield

Commodities

- The Bloomberg Commodity Total Return Index was down -5.36 %

- Sugar (up 18.87%) and copper (up 7.09%) were best performers

- Natural gas (-50.09%) and nickel (-21.38%) were worst performers

Looking Forward

The collapse of Silicon Valley Bank in early March spurred fear amongst many investors with the 2008 banking crisis fresh in their memories. Although investors were rightfully on edge, the fall of SVB is quite different than what happened during the 2008 financial crisis. Leading up to the 2008 financial crisis, some banks were engaged in risky business including subprime loans. When the real estate boom turned out to be a bubble that eventually burst, many borrowers defaulted on their loans. With the number of bad loans far exceeding the banks’ reserves, failures occurred. The collapse of SVB was caused by the absence of risk management and diversification. SVB had a unique client base predominately consisting of venture capital and startup firms. During the post-pandemic environment, massive amounts of stimulus money created a boom period for these businesses, causing SVB deposits to surge between 2020 and 2022. During this time, how SVB invested could be considered risky (especially during interest rate increases) with many investments made in long-term treasuries and agency mortgage-backed securities. When the Fed started raising rates, SVB clients were no longer flush with cash and began withdrawing. SVB struggled to keep up with demand and on March 9th withdrawals accelerated to the point that the bank could not meet requests. On March 12th the Fed, Treasury, and FDIC announced that all depositors at SVB will have full access to their funds beginning on March 13th. In addition, the Fed created the Bank Term Funding Program offering loans to banks for up to one year.

This recent collapse of the second largest bank since 2008 may bring up the question of your own financial protection. Although all investing involves risk, there are some important protections in place to ensure transparency. Paradigm Wealth Management relies on qualified custodians to hold all clients’ assets that we manage. This is in accordance with the Security Exchange Commission. At PWM we strive to balance potential risk with return. Our financial planning process determines our clients’ target investment allocation based on individual situations with consideration given to tax mitigation strategies and personal cash needs. Our technology platform is used to monitor portfolios and ensure that they are not drifting too far from our target allocations. As we continue to manage each of our client’s investment plans, it is important to remember three important principles.

- Uncertainty is Unavoidable. During the last three years, we have experienced a pandemic, the Russian invasion of Ukraine, spiking inflation, and ongoing recession fears. Despite these uncertainties, for three years ending in late February, the Russell 3000 Index (a broad-market capitalization weighted index of public U.S. companies) returned an annualized 11.79% .

- Market Timing is Futile. It is easy to panic when times are bleak, but research repeatedly shows that timing strategies are not effective. The risks of miscalculating timing strategies far outweigh the perceived benefits.

- Diversification is key. Thanks to financial innovations such as mutual funds and exchange traded funds, investors have the opportunity to easily diversify. By maintaining a diversified portfolio with your long-term goals in mind, you will mitigate your risk while creating opportunity for growth.

By looking at your entire financial picture while maintaining transparency, Paradigm Wealth Management strives to provide the expert guidance to each of our clients. We continue to appreciate your trust and are always available if you have any questions or concerns.

The Paradigm Wealth Management Team

Sources: Fidelity Investments, BlackRock, DFA, Vanguard, Officialdata.org