Q2

Stocks have defied expectations during the first half of the year with the S&P 500 posting double digit returns despite inflation remaining elevated. Artificial Intelligence has become the latest buzzword, ultimately driving the steep rise in megacap stocks that have dominated performance in the U.S. equity market. The Federal Reserve held rates steady in June, spurring some optimism amongst investors with most asset categories rebounding in 2023 following the broad-based downturn of 2022. Given the long lags between monetary policy and noticeable changes in economic activity, The Federal Reserve policymakers could determine that the rate increases they have made since March 2022 are enough to lower inflation to the 2% target rate, but the majority viewpoint is that another rate hike is imminent. Although the recent upturn in U.S. equity markets has been encouraging, most analysts remain cautious as uncertainty remains high regarding the Fed’s next move, inflation, and a possible recession.

Global Economy

Many central banks have continued to tighten policies. The European Central Bank has hiked interest rates 4 percentage points in 12 months in an attempt to curb inflation. Eurozone equities have performed broadly in-line with U.S. equities but may soon face challenges due to tightening monetary policy and a recession risk. Persistent inflation has clouded the UK economy with core inflation at more than a 30-year high. GDP in the UK has experienced minimal growth over the last year and remains lower than in 2019. China’s growth appears to be slowing after a strong first quarter with data indicating that the Chinese consumer is cautious. Globally, Japan appears to be the outlier, maintaining ultra-accommodative monetary policy and strong GDP growth.

- Developed Stocks underperformed the U.S. market but outperformed emerging markets

- International Developed Stocks increased 3% for quarter

- Value outperformed growth

U.S. Economy

The U.S. equity market posted positive gains for the second quarter this year. The S&P 500 officially entered bull market territory on June 8th after rising by at least 20% since its low last October. Positive momentum heading into the second half of the year could put the S&P 500 on track for its best annual performance since 2019. Consumer spending was resilient despite inflation, resulting in a 9% increase for the quarter and 17% year-to-date. A recent technology rally as investors speculated on who will lead innovation in A.I. has led to gains among a handful of large technology companies. U.S. Growth stocks saw the highest increase with 12.5% for the quarter and 28.1% for the year. U.S. inflation fell from a peak of 9% to 4%, yet core inflation remains stickier. Additional rate hikes are anticipated later this year as Federal Reserve Chair, Jerome Powell, has emphasized that letting inflation become entrenched is a bigger mistake than overtightening and causing a recession.

Equity Markets

-

- Big growth stocks bounced back strong increasing 12.81% for quarter and 29.02% YTD

- Value stocks lagged increasing 5.12% YTD

- Small caps underperformed large caps

Fixed Income

-

- Interest rates increased across all bond maturities in U.S. Treasury Market for quarter

- High-Yield Credit – best performing asset

Commodities

-

- The Bloomberg Commodity Total Return Index increased 2.56%

- Live Cattle (up 10.8%) and soybean oil (up 10.26%) were best performers

- Zinc (-18.1%) and nickel (-14.67%) were worst performers

Looking Forward

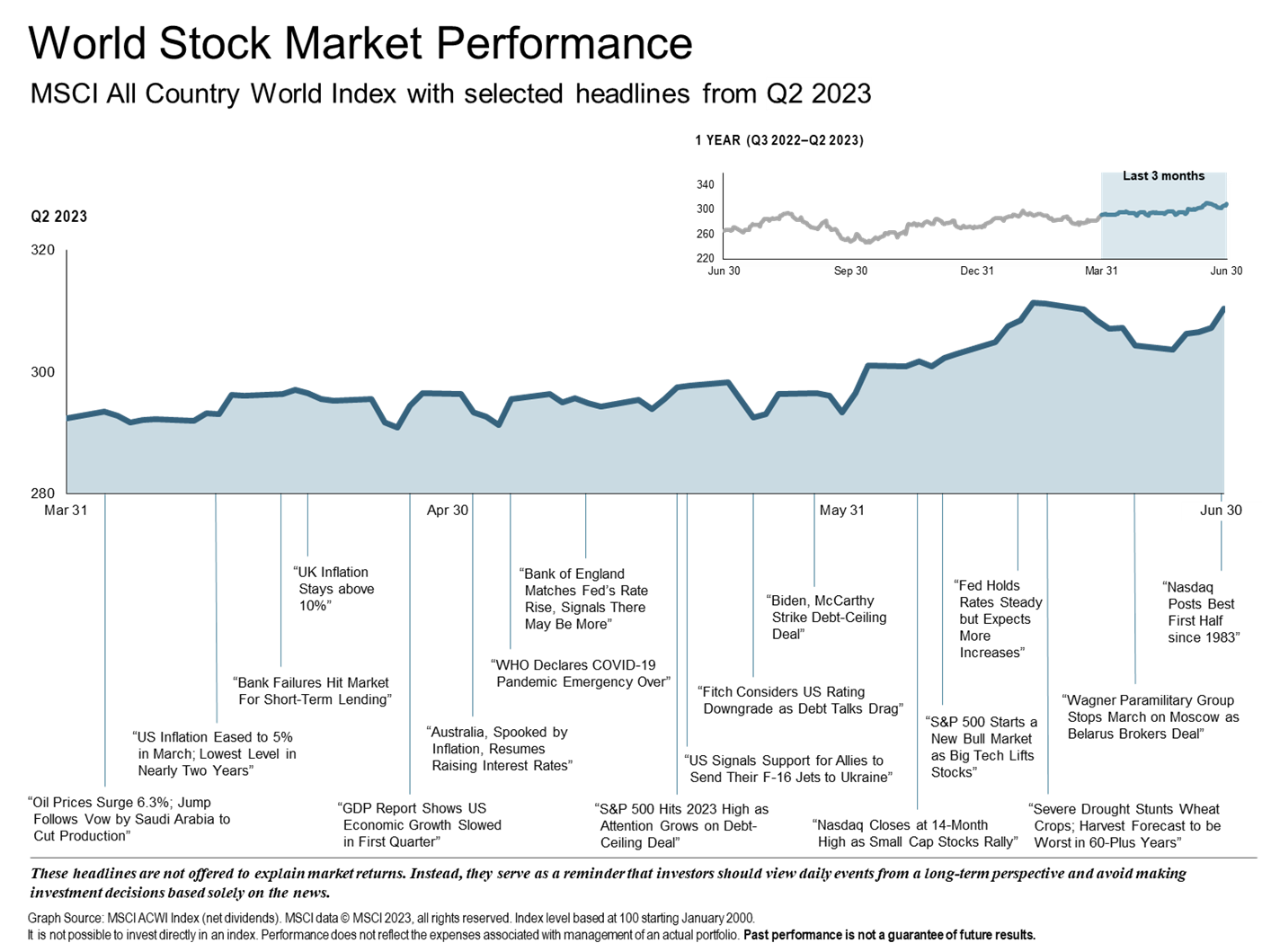

Watching the markets’ day-to-day fluctuations can be captivating. Numerous events including geopolitical turmoil, instability within the banking industry, earnings reports, changes in supply chain, and inflation (just to name a few) can temporarily change a portfolio overnight. It can be tempting to jump on the bandwagon as emotion builds surrounding your personal investments. By resisting impulsivity driven by the headlines and maintaining a portfolio balanced across the risk spectrum, you will increase your opportunity for long-term growth.

The recent stock market rally may continue through the second half of the year, but given the number of risk factors, investors should remain cautious. Elevated interest rates and the risk of a recession are high on the list of potential roadblocks in coming months.

Paradigm Wealth Management is here to help ensure that you have the right long-term plan for your personal situation. Timing the market is impossible, but remaining abreast of strategic opportunities and long-term trends in economic and policy conditions is our job. We actively monitor each investment so that your portfolio aligns with your goals. Thank you for your continued trust in our services. As always, do not hesitate to reach out if you have any questions.

The Paradigm Wealth Management Team

Sources: Fidelity Investments, BlackRock, DFA, Vanguard, Officialdata.org