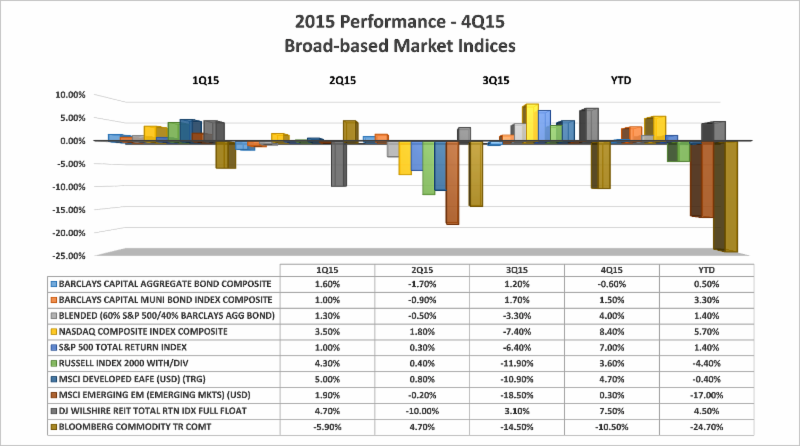

For the last 3 months of the year, markets were positive with the exception of commodities. Yet, as you can see below, the increase was not enough to make up for the downturn affecting most asset classes earlier in the year. A diversified stock, bond and alternative portfolio lost modestly in 2015 for the first time in seven years. The S&P 500’s -0.7% (without dividends) return ended three years of double–digit gains for the index, but came nowhere near the 40% decline experienced in 2008. A first time interest rate increase by the Federal Reserve not experienced since 2006, a strengthening dollar versus other currencies, plunging oil and commodity prices, and continued declining growth in China weighed on U.S. and global equity markets.

Of interesting note, most of the returns within the S&P 500 came narrowly from four stocks, Facebook, Amazon, Netflix and Google (Alphabet) which were up over 60% on a market-cap weighted basis. These stocks are known for trading at high prices in relationship to their earnings. As an example, on 12-31-15, Amazon (AMZN) was trading at 1000 times its earnings, and does not pay a dividend. In contrast, stocks that trade at prices closer to earnings, and pay dividends, closed the year negatively; like Warren Buffet’s, Berkshire Hathaway, a conglomeration of dividend paying companies, was trading 14.3 times its earnings and was down -12.06% on 12-31.15. Many experts believe this is a result of a higher risk-taking mindset that investors have acquired due to the unusually low interest rate environment of the past 7 years. A performance reversal of growth style companies to value style could arise with future interest rate increases. As history shows, all companies in the long term must produce earnings in order to support their prices.

For all the anxiety surrounding the first Fed interest rate hike, overall returns for bonds were slightly negative for the quarter and slightly positive for the year. However, depending on the sector, such as high yield, returns could have declined as much as -7.0%. We recommended clients exit the sector earlier in the year.

Developed international equities were up for the quarter, yet like the S&P 500 (without dividends) were negative for the year. Emerging markets suffered from fears of a strengthening dollar, increasing dollar-based debt payments and slowing revenues from China.

Lastly oil, and in general, commodities continued to slide. Ultimately when inflation picks up, or as it pertains to oil, supply matches demand, an improvement will occur. It is hard to see falling returns, however we believe long term these are important assets to all economies and therefore should have a place in a diversified portfolio. At the moment, dividends from these positions and domestic real estate trust companies (REITs) are providing a return to somewhat offset these declines.

As we entered the New Year, and at the writing of this update, equity markets have continued to trend down, fixed income up, and alternative income mixed. Most experts we follow believe the market is re-assessing growth in a rising interest rate, dollar environment. In addition, worries about China’s growth recession and stumbling transition to a more market-oriented economy, is affecting all, especially emerging market stocks, real assets, and commodities which include oil. Although risk exists for a global recession, the majority opinion is, a healthy tug of war is ensuing, with a low but positive growth prognosis. Interest rates are predicted to also move up in a slow and steady fashion.

From our perspective, investing is about disciplined aggregate returns over time, and not just a calendar year return. Negative and positive periods of return are necessary inputs to the outcome of gains that exceed inflation and taxes, long term. We look forward to continuing to serve you in the New Year, and to be an important resource as market conditions develop.

Resources: Morningstar, WSJ, Google Finance, Fidelity