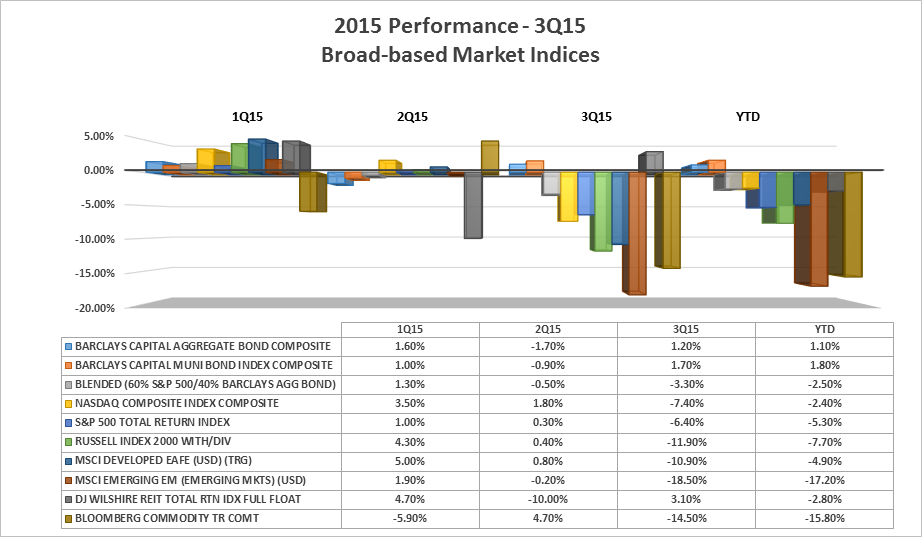

The third quarter 2015, for most investment asset classes ended with negative returns. The S&P 500 lost 6.4% total return for the quarter, and based upon closing prices, declined 12.35% from its record high of 2130.82 on May 21st. You may recall, the beginning of the quarter was consumed with ongoing concerns about Greece exiting the Eurozone and China’s stock market declines. This, along with anxieties about the timing of interest rate increases here in the U.S. for the first time since 2006, and an unexpected devaluation of the Chinese Yuan in mid-August, contributed to declining equity markets across the globe. Emerging markets, which include China’s exposure, fared even worse, tumbling by 18.5%. Nor was there any respite in commodities, with oil, natural gas and copper all suffering double-digit percentage losses.

On the bond side of the portfolio a different story; positive returns were experienced in America, Germany, Italy and Japanese government bonds, in addition to U.S. municipality debt. Publicly traded REITs also fared well as fears of a “liftoff” of interest rates from the Fed dissipated on 9/18.

At the point of writing this commentary, most markets have improved from quarter end. In retrospect, the sudden volatility experienced in August from a sideways moving market throughout most of 2015, felt dramatic. However, based upon history, steep drops have happened with more frequency only to reverse course quickly. A respected advisory firm, Dimensional Fund Advisors, noted S&P 500 stock prices have declined 10% or more on 28 occasions between January 1926 and June 2015. They also go on to share that U.S. stocks have typically delivered above-average returns over one, three and five years following successive negative return days, with a 10% or more decline. Results from non-U.S. markets are similar.

Looking ahead, most experts feel the recent dip was a healthy correction as opposed to a forewarning of recession. Chinese growth along with the timing of U.S. interest rate increases and bottoming of commodity prices, including oil, will still be possible culprits to additional jittery markets. Yet on the positive side, the U.S. and Europe continue to grow, albeit slowly, in a low interest rate and commodity-priced environment, at now lower valuations. A consensus of economists tracked by Bloomberg is forecasting higher global growth in 2016. The Fed continues to be data-dependent and cautious on the timing of interest rate increases. We prefer the term “takeoff” (used by Vanguard) as opposed to “liftoff” in describing how the Fed may conclude their zero interest rate policy, this year or beyond. Continued stimulus by foreign central banks, with little inflation also supports growth overseas. Rising employment, low inflation, and a stronger housing sector here in the U.S., permit the consumer to increase spending. All things considered, an argument could be made for a continued rising global stock market.

We believe it’s imperative to employ a disciplined and diversified approach to managing various market and economic risks in client portfolios As always, we are available to answer any of your questions and concerns, or discuss your financial plans.