Q4 Overview

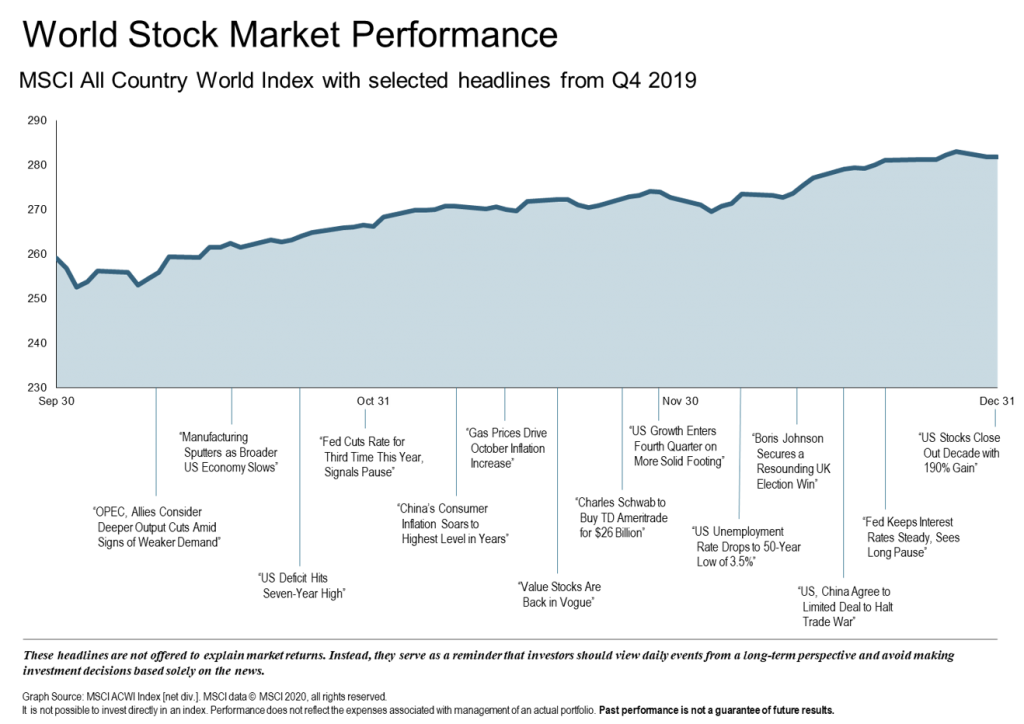

Economic expansion entered its 11th year last year, making it the longest run since 1900. In fact, 2010-2020 is the only decade in which the U.S. has not experienced a recession. Favorable policy developments in Q4, including monetary easing by the Federal Reserve and a de-escalation of U.S./China trade tensions, helped stock markets to finish strong in 2019. The global economy remains sluggish, but there are signs that recessionary conditions in major European nations may be improving. For full-year 2019 all major asset classes recorded gains. Monetary easing and lower interest rates boosted returns to bonds, and U.S. large cap equities led the outperformance of U.S. vs. non-U.S. stocks.

Key takeaways from Q4 as we move into the new decade are as follows:

Global Economy

- Global Central Banks have shifted toward easing monetary policy

- U.S./China agreed to a limited deal, halting a trade war

- Global cycle is in a mature phase cycle with hints of improvement in some areas and signs of bottoming in global trade and industrial activity

- Monetary easing is boosting liquidity but may not be enough to accelerate global growth

Equity Markets

- Emerging markets and non-U.S. small cap equity segments led fourth quarter gains

- All major asset classes posted positive results for 2019

- Value underperformed growth in U.S. across large and small cap stocks

Fixed Income Markets

- Long-duration bonds were the worst performing in Q4, but registered a 20% gain for the year

- Bond yields remain in their lowest decile relative to history

- Credit spreads in most categories are well below their averages

Commodities

- Bloomberg Commodity Index Total Return increased 4.42%

- Coffee and Soybeans were top performers, gaining 24.33% and 17.62% respectively

- Nickel and natural gas were worst performers, declining by 17.97% and 17.57% respectively

2010-2020 Decade

- U.S. Growth and Tech Stocks dominated the decade

- U.S. Stocks closed out decade with 190% gain

- More cyclical U.S. equity sectors performed the best

- Non-U.S. assets and market segments tied to global commodities fared poorly

- Growth outperformed value stocks by 3.5 percentage points on annualized basis

Looking Forward

As we begin 2020, economic expansion is moving into its 3rd decade of existence. That trend appears to be continuing in early 2020, yet it is important to remember that the U.S. is firmly in the late-cycle phase with monetary and trade policy uncertainty being risks. Overall, the global cycle remains in mature expansion with hints of improvement in some European nations. The U.S. has a relatively low near-term recession risk with declining interest rates and tight employment conditions supporting consumer spending, yet some leading indicators suggest that the labor market may be at peak levels. Global economic policy uncertainty rose to unprecedented levels in 2019 with an unclear outlook on monetary policies, trade conflicts, and BREXIT leading the overall uneasy sentiment. The de-escalation of U.S./China trade tensions in late 2019 provided some relief to investors, however international trade tension remains a risk.

For investors, access to constant news and media can result in emotional responses. It is important to recognize that markets can be volatile and adapting a long-term investment approach can ease worry during uncertain times. At Paradigm we look to provide the expertise, perspective and encouragement to keep you focused on your destination.

The Paradigm Wealth Management Advisory Team

References: Fidelity Investments, BlackRock, DFA