MARKET COMMENTARY & OUTLOOK

Third Quarter 2019

Q3 Overview

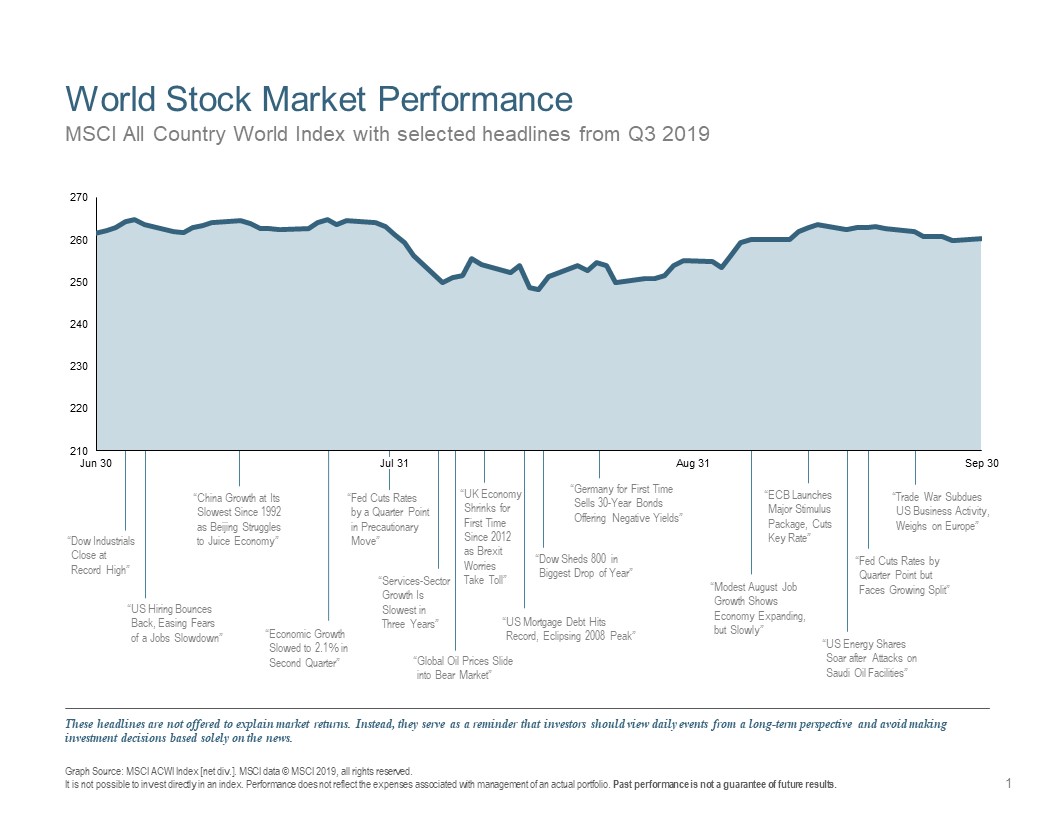

As expected, 2019 has proven to be slightly unpredictable. Unforeseen policy changes caused market participants to reassess their world growth outlook in Q3. A dramatic reversal of monetary policy by world central banks and a substantial escalation in the U.S.-China trade conflict injected additional uncertainty into the growth projections for world economies. Volatility spiked as investors tried to gauge whether a manufacturing retrenchment in Europe and a slowdown in China could disrupt the economic expansion. Continued strong consumer household spending, a robust service’s sector and a 5-decade year low in the unemployment rate countered skittish concerns. With interest rates coming down once again, experts are using the term “Stretched” or “Extended” to describe the current economic expansion. We are in the late stages of a business cycle which is showing some signs of slowing, yet several previous mid-cycle pauses showed that this current expansion could continue for some time.

Global Economy

Recently, the global economy has had center stage due to U.S./China tensions, Brexit related uncertainty, and the Central Bank introducing a fresh stimulus package in September. On 9/1 the U.S. implemented tariffs on approximately $104 billion worth of imports from China. This move resumed trade talks with hope that progress will be made. Corporate confidence, business capital spending and manufacturing have been affected by the trade-war, ensuring a watchful eye as we head into Q4. Following the attack on a Saudi Arabian oil refinery, oil prices increased sharply. The disruption impacted approximately 5% of the worlds’ daily oil production. Production appears to already be resuming, with hope that oil prices will level out in coming months.

Equity Markets

It was a mixed quarter for shares, with developed markets making small gains while emerging markets fell. U.S. equities continued their positive run, achieving increases with stocks in the financials, utilities and energy sectors advancing the most. Eurozone shares and UK equities recorded modest gains while Asia equities (excluding Japan) lost value amid increased tension regarding trade and rising concerns over their export economies.

Fixed Income Markets

The third quarter saw an impressive bond rally across all sectors due to lower interest rate policy by central banks and demand by investors for more risk-averse type investments. The U.S. 10-year Treasury yield, which peaked last year at 3.25%, moved over 30 basis points lower for the quarter, and ended at 1.67%. Corporate bonds outperformed government bonds as investors accepted more credit risk to lock in higher rates. Similarly, emerging market bonds, corporate debt and local currency government debt also made positive returns while emerging market currencies weakened against the U.S. dollar.

Commodities

As investors moved into perceived safe havens, precious metals also delivered solid gains with gold and silver up 4.5% and 11% respectively. Energy was the weakest component, amid a selloff in crude oil prices as demand concerns outweighed ongoing supply risks. Prices did spike temporarily following the attack on a Saudi Arabian oil refinery yet moved lower upon a quick resumption of production. Agricultural commodities were also weaker, led by corn.

Looking Forward

During this continued late-cycle phase higher volatility is expected. The Fed has indicated it will continue to accommodate if there are signs of economic weakness. Despite some geopolitical noise blurring a favorable growth outlook, market analysts continue to forecast a positive U.S. economic expansion through year-end. The threat of a recession has increased but still remains low in the near term. Moving forward, political and policy-related risks, Q3 corporate earnings and employment survey releases, will be some of the variables we watch. Currently, we are emphasizing investment themes within a diversified portfolio which continue to participate in the economic expansion, which includes building-in defensiveness to withstand potential adverse conditions.

As always, Paradigm Wealth Management strives to exceed your expectations. We appreciate the confidence that you place in us and encourage open communication as we navigate the dynamic market.

The Paradigm Wealth Management Advisory Team

References: Fidelity Investments, BlackRock