We are all now living through a period in history that none of us will ever forget. The impact on our families, communities and country has been profound. Uncertainty, worry, and fear about COVID-19 and its lasting impact continue to affect our daily lives. Questions abound – how long will it last, how far will it spread, when will we see signs of stabilization and a “flattening of the curve”? We’ve frequently said that recessions and bear markets are inevitable phases in a cyclical market and, although timing the market is impossible, investors need to be prepared. It’s one thing to say it and another to live it. In addition, when the catalyst for the recession is a global pandemic that none of us has experienced before, it is hard for all of us to make sense of what is happening. As we navigate through this unprecedented time with events changing rapidly, it is important to remind ourselves that we will get through this. Things will improve. The economy will recover.

Q1 Overview

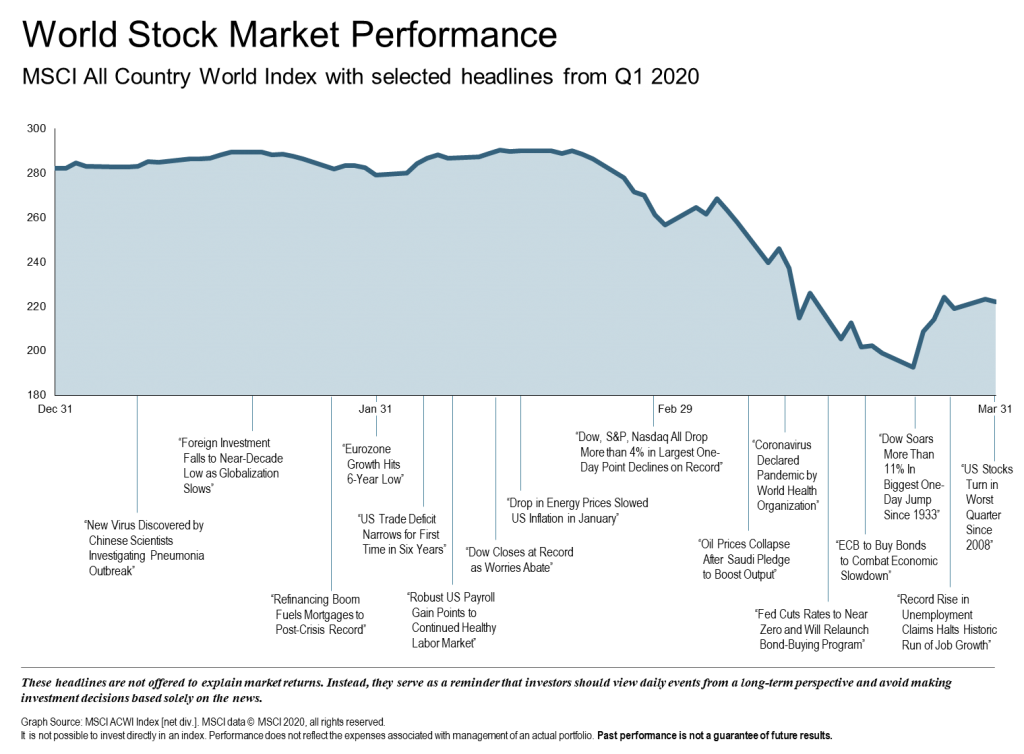

Just months ago, most investors were surprised to see the eleventh year of a historic bull market. The U.S. economy, although in the mature cycle phase, was performing moderately well. There were some apparent weaknesses: manufacturing had been suffering, the labor market showed signs of being at peak levels, and international trade tension was a risk. Yet, no one anticipated that the landscape would change so dramatically at the end of the first quarter. In March, the global response to COVID-19 rapidly pushed the world into recession. Quick and expansive U.S. monetary and fiscal policy helped mitigate the most acute near-term liquidity issues. This should provide a partial offset to potential economic damage, but uncertainty and volatility are likely to remain high. Here is a brief overview of major events during Q1:

January: Wuhan, China, a city of 11 million, shut down due to the spread of novel coronavirus, a strain first identified in early January. Global equities began sell-off mid-month as the disruption in China impacted companies around the globe. The S&P ended the month -0.16%.

February: Wider spread of the virus in China, hot spots in Italy and Iran, and scattered cases around much of the world. The disease caused by the virus was named COVID-19. The U.S. saw its first death on the 29th and the U.S. government issued travel warnings for hot spot countries. The S&P 500 closed the month down 12.5% and in bear market territory.

March: Oil markets crashed – after closing the year around $60 per barrel, a price war between Russia and Saudi Arabia combined with collapsing global demand, caused oil prices to drop 66% for the quarter. By mid-March, the CDC recommended limiting the size of gatherings, states and companies began stay/work-at-home policies, many countries limited entry to non-residents, and the U.S. passed a $2 trillion stimulus plan. The S&P 500 closed the month down 12.5% and in bear market territory.

Global Economy

- COVID-19 and government ordered shutdowns caused a mostly late-cycle global economy to descend into recession

- China activity is still extremely weak, but no longer deteriorating

- Global decline in commodity prices – particularly oil prices – will likely reduce investment spending in the U.S.

- Many analysts expect the dollar to weaken as the crisis abates and a global recovery resumes, potentially boosting foreign stock returns

Equity Markets

- U.S. stock market fell into a 20% bear market in the shortest time ever

- Small-cap, value and energy stocks suffered the worst losses among equity segments

- Emerging-market stocks have outperformed U.S. stocks in local-currency terms – dropping 19%

Fixed Income Markets

- Almost all asset classes suffered, including most bonds

- S. 10-year Treasury yields fell 122 basis points – ending below 1% for the 1st time

- Government Bonds benefited as a safe-haven asset – ending up 6.2%

- Treasuries posted positive results – 8.2%

Commodities

- Commodity prices declined sharply

- Energy prices were down 35%

- Inflation Adjusted oil prices near their all-time low

- Gold performed well in comparison to other commodities, ending positive 6%

Looking Forward

As we head into Q2, uncertainty will continue. The financial impacts of “flattening the curve” are not yet understood. In addition to many unanswered questions surrounding COVID-19, additional factors may have a long-term impact on the economy. Risk factors such as: slower U.S. economic growth due to aging demographics, rising policy and political risk, peak globalization, and unintended consequences of extraordinary monetary policy may all impact the market looking forward.

While no one can predict how quickly the economy will recover, forward estimates point to a rebound of earnings growth over the next 12 months. Federal virus relief legislation should help mitigate the devastating loss of economic output and the immediate impact is likely to fade as a vaccine or the natural progression of an epidemic reduces the number of infections and consumer spending increases.

During this trying time, it is important to remember the need for a disciplined investment strategy. Although the business cycle can be a critical determinate over the immediate term, portfolio returns tend to even out over the long-term. At Paradigm, we are constantly monitoring your portfolio and are making appropriate adjustments while remaining true to our core values. We will remain in touch with you regularly but encourage you to reach out at any time if questions arise. We wish you and your family the best during this truly difficult time and thank you for your continued trust.

The Paradigm Wealth Management Advisory Team

References: Fidelity Investments, BlackRock, DFA