Q2 OVERVIEW

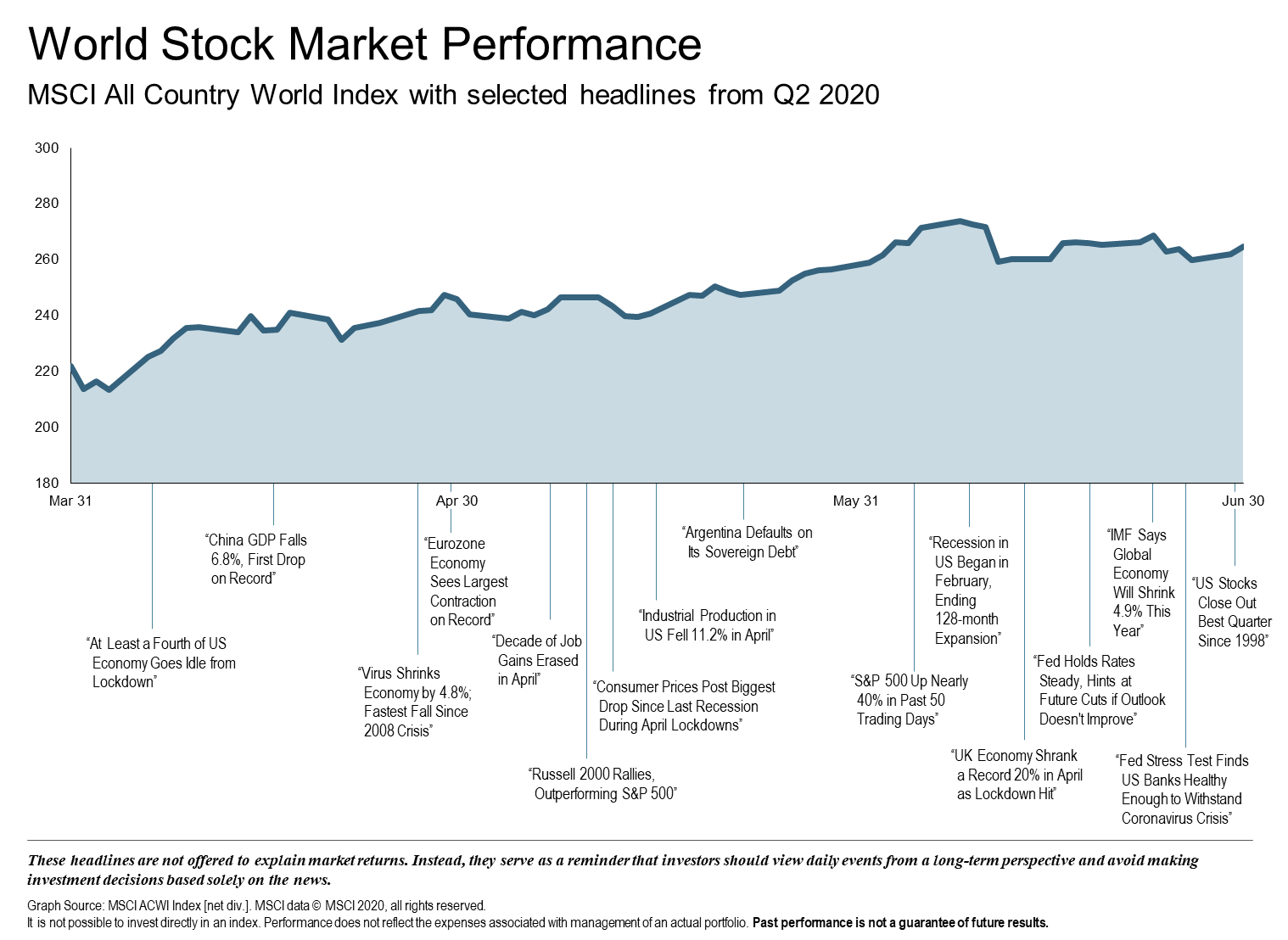

The world has changed since our Q1 update. Following the largest drawdown in the history of global equities during the first quarter, the second quarter saw the largest 50-day advance in market history. The global coronavirus pandemic has turned everyone’s lives upside down, stirring more angst in a few months than we often see in years. The U.S. economy experienced historic slowdown in April with 95% of the population under stay-at-home orders. The fiscal and monetary response, however, has been extraordinary. The Federal Reserve has provided $2.4 trillion in stimulus for citizens and businesses by dropping interest rates to zero, restarting its quantitative easing policy, and announcing its intention to purchase corporate bonds, municipal bonds, and asset-backed securities to support the economy. As we look toward recovery, there is equal reason to proceed with both caution and optimism. Economic conditions will largely depend on the trajectory of COVID-19 and continued policy support. Uncertainty and volatility are likely to remain high throughout the remainder of 2020, meaning that a well-diversified portfolio is more important than ever.

Global Economy

Global activity showed early signs of improvement from extremely low levels. China appears to be somewhat ahead of most major economies due to its earlier shutdown and reopening. European countries are emerging from a lockdown and, so far, there has been no evidence of a significant second wave of infections. The U.K. has been hit hard by COVID-19. High infection and death rates are delaying the easing of lockdowns with economic uncertainty being compounded by the Brexit negotiations. Long term, the anti-globalization trend will likely continue with the virus accelerating the process. The longstanding global regime of relatively stable and investment-friendly policies, politics, and regulation is nearing an end. Global supply chains are being unwound and the pandemic has created fears about food supply and pressure for domestic production of medical supplies.

- Positive returns for equity markets around the world

- Changes in government bond interest rates in global developed markets were mixed

- Longer term bonds outperformed shorter-term bonds in global developed markets

U.S. Economy

After experiencing a historic slowdown, the U.S. government quickly responded with the most significant fiscal thrust since WWII. U.S. stocks posted the best quarterly results in 20 years while a decline in credit spreads boosted returns on corporate bonds. Uncertainty surrounding the United States’ trade stance resulted in some wavering mid-quarter, but continued dovishness from the Federal Reserve and indications of progress in trade tensions helped investors’ confidence. The more cyclical areas of the market generally performed strongly with financials, materials and IT all generating robust gains. Healthcare remains challenged and energy stocks largely declined during the second quarter.

Equity Markets

- U.S. equity markets outperformed non-U.S. developed markets and emerging markets

- Value underperformed growth in the U.S. across large and small cap stocks

- Small caps outperformed large caps

Fixed Income Markets

- Yield on 5-year treasury note decreased by 8 basis points

- Yield on the 10-year treasury note decreased by 4 bps

- Yield on the 30-year treasury note increased by 6 bps

Commodities

- S&P GSCI (Commodities) Index rallied in Q2

- Energy posted sharp gain

- Industrial Metals posted positive return led by iron ore and copper

- Precious metals advanced with silver gaining the most

- Agriculture sector was negative with coffee and wheat notably weak

LOOKING FORWARD

Reasons for Optimism

- Solid Economic Foundation – the U.S. economy was healthy prior to the COVID-19 crisis. The ensuing recession was caused by exogenous shock, not a typical end to the business cycle. This could hold promise for the recovery.

- Credible, Coordinated Policy Response – the global coordination, swiftness and magnitude of the monetary and fiscal policy response is unprecedented and should help to bridge the gap toward economic renewal.

- Attractive Value vs. Bonds – the gap in value between stocks and bonds is wide suggesting investors can potentially realize greater reward from stocks.

- Increased Alpha Potential – wide valuation spreads mean increased dispersion across individual stocks and an opportunity for active portfolio management to make a difference in returns.

Reasons for Caution

- Hidden Vulnerabilities – the lockdown-driven decline in economic activity and spike in unemployment has left the U.S. economy more exposed to risks. Hiccups in the reopening process could expose some vulnerability in the market.

- Risk of Second Wave of Infection – A new round of infections is possible. Its effect on the healthcare system and renewed closures is unknown. The upside is that we are wiser and more prepared if this happens.

- Heightened Geopolitical Tensions – The U.S.-China relationship is further strained. If tensions flare, market volatility is likely. The move towards deglobalization will have margin and inflation implications down the road.

- Absolute Valuations are Not Cheap – Stock prices are attractive relative to bonds, but the P/E ratio tells a different story. Stock process relative to 12-month forward earnings per share was 21x at the end of May.

As we continue to make our way through 2020, its important to keep the overall picture in mind. When looking back at the last decade, most people would agree that it was a decade of solid growth. At the beginning of 2010, following the 2008-2009 financial crisis, many investors were contemplating whether it was prudent to stick with their investment plan or move to cash and wait for more evidence that the market had recovered. The S&P’s annualized return during the 2010s was 10.8%. Despite positive annual market returns during most of the decade, investors had to process ever-present uncertainty arising from a host of events, including an unprecedented U.S. credit rating downgrade, sovereign debt problems in Europe, negative interest rates, flattening yield curves, the Brexit vote, the 2016 presidential election, recessions in Europe and Japan, slowing growth in China, trade wars and geopolitical turmoil in the Middle East, to name a few.

Despite all the change and uncertainty, the fundamentals of successful investing endured. Diversification across markets and asset groups coupled with a disciplined, long-term approach has historically proven to return positive results. Keeping daily news in perspective and avoiding making reactionary decisions based on fear and anxiety will also prove to be beneficial. No one can predict future performance or time the market. Instead, it is important to develop a sensible investment plan based on a strong philosophy and stick with it. At Paradigm we look to provide the expertise, perspective and encouragement to keep you focused on your destination.

The Paradigm Wealth Management Team

References: Fidelity Investments, BlackRock, DFA