How the Financial Market May Influence Your 2021 Investment Outlook

After a tumultuous 2020 filled with much fear and uncertainty, the United States and much of the developed world are rapidly recovering as we continue our path to normalcy. Growth driven by government stimulus, low interest rates, and the rollout of COVID-19 vaccinations has led to strong gains in equity markets. The S&P 500 has seen returns of 15.25% YTD which is the second strongest to start a year since 1998. U.S. gross domestic product rose at an annualized 6.4% in the first three months of the year, and, according to the International Monetary Fund, this growth rate is expected to continue throughout 2021.

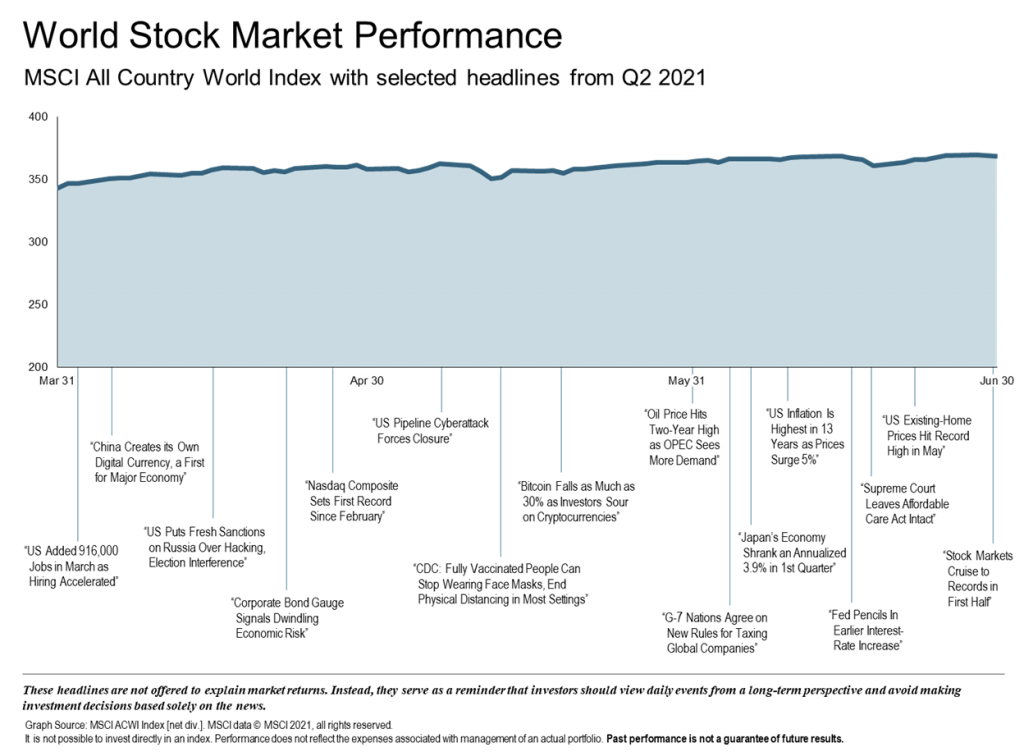

2021 Q2 Financial Market Overview

During the second quarter, taxes and inflation weighed heavily on the minds of investors. The Biden Administration’s proposal to raise taxes of high-income earners and to increase corporate taxes has raised some investor concern, yet history shows that contrary to conventional wisdom, the S&P 500 has generated higher average returns under periods with increasing taxes. In fact, going back to 1950, there was only one instance of a negative stock market return following the last 13 tax hikes.

Inflation was also a hot topic this past quarter as many businesses experienced upward pricing from supply chain disruption, higher material costs, and shipping constraints. The consensus among investment strategists is that price-pressures are mostly transitory, resulting from a temporary supply bottleneck coupled with an increase in consumer demand largely due to the economy reopening and a significant rise in disposable income of Americans during the first quarter of the year.

In mid-June, the Federal Reserve announced that interest rates would remain near-zero but indicated that it may back away from its easy money policies with two federal fund rate hikes in 2023.

World Economic Outlook

The global economy is expected to expand 5.6% in 2021, the largest post-recession pace in 80 years. This projected expansion is largely due to strong rebounds in a few major economies. Renewed COVID-19 outbreaks in many countries, a slowing growth in China, and a shift in the Federal Reserve policy stance has influenced high U.S equity valuations in comparison to other areas around the world.

- Global equities continued to advance, led by U.S. stocks.

- Vaccination remains uneven across countries, affecting recovery.

- Growth in China slowed significantly from record expansion in Q1.

- Low vaccination rates in Japan have slowed recovery, but accelerated growth is expected in summer months.

- Canada’s growth should broaden during second half of 2021 as greater mobility benefits previously locked-down services sector.

- A strong rebound in UK is expected as it recovers from both Brexit and the pandemic.

U.S. Equities

The S&P 500 ended the quarter at an all-time high, increasing by 8.2%. This marks five consecutive quarter gains since the market sell-off during the first quarter of 2020. Positive catalysts to such strong returns include ongoing accommodative policies, a massive fiscal stimulus, success in the vaccine roll-out, economic reopening momentum, and a strong corporate back drop. While the first quarter of the year was heavily influenced by reflationary trade, the second quarter saw movement back to growth stocks. Top growth sectors in Q2 were information technology, real estate, and communications.

- U.S. equities outperformed non-U.S. developed and emerging markets.

- Value underperformed growth in large cap stocks.

- Small caps underperformed large caps.

Fixed Income

The Bloomberg U.S. Aggregate Bond index increased by 1.8% in the quarter as the decline in interest rates was positive for returns. Other areas of the fixed income market also produced solid results, including a 3.6% increase for Corporates and a 1.4% increase for Munis. The first quarter trend of higher long-term treasury yields reversed during the second quarter. One of the biggest surprises of the quarter was the decrease in the 10-year treasury yield after reaching an all-time low in August 2020.

- Yield on 5-yr U.S. Treasury note decreased 76 bps

- Yield on 10-yr U.S. Treasury note decreased 28 bps

- Yield on 30-yr U.S. Treasury note decreased 356 bps

Commodities

Commodity prices continued to surge through much of the second quarter, peaking in May. All sectors posted gains in Q2 and over the first half of 2021. Recently, real prices have declined, with lumber falling 45% in June. Soybean and natural gas were the quarter’s best performers, increasing 32% and 30% respectively. Although showing more modest gains in Q2, Energy was the best performer for the S&P 500 year-to-date with an increase of 42%.

- The commodities asset class gained 10.76% in Q2

- Energy leads the way for second consecutive quarter

- Volatility expected in Q3

Looking Forward: Market Outlook 2021

It is hard to believe that we have already reached the half-way point of 2021. Global economic progress, along with supportive monetary and fiscal policies, have been important catalysts to exceptional U.S. equity performance. As we continue to move into the third quarter, we will be watching some key economic indicators.

Inflation and employment gauges will influence the Fed’s decisions on interest rates and asset purchases. Timing and pace of its decisions will likely play a major role in market performance. In addition, massive government spending over the last fifteen months has helped market returns. The approval of further spending, specifically on infrastructure and social services, could impact future volatility.

At Paradigm Wealth Management, we believe in a consistent, diversified approach. A major milestone that we would have never anticipated two years ago was reached this past quarter – our first in-person meeting in more than a year! We are ready and eager to meet with you however you feel comfortable – in person or remotely. Our team values your business, and we look forward to continuing to provide you with unparalleled service, financial expertise, and more financial market commentary.

The Paradigm Wealth Management Team

References: Fidelity Investments, BlackRock, DFA, Worldbank.org, Reuters