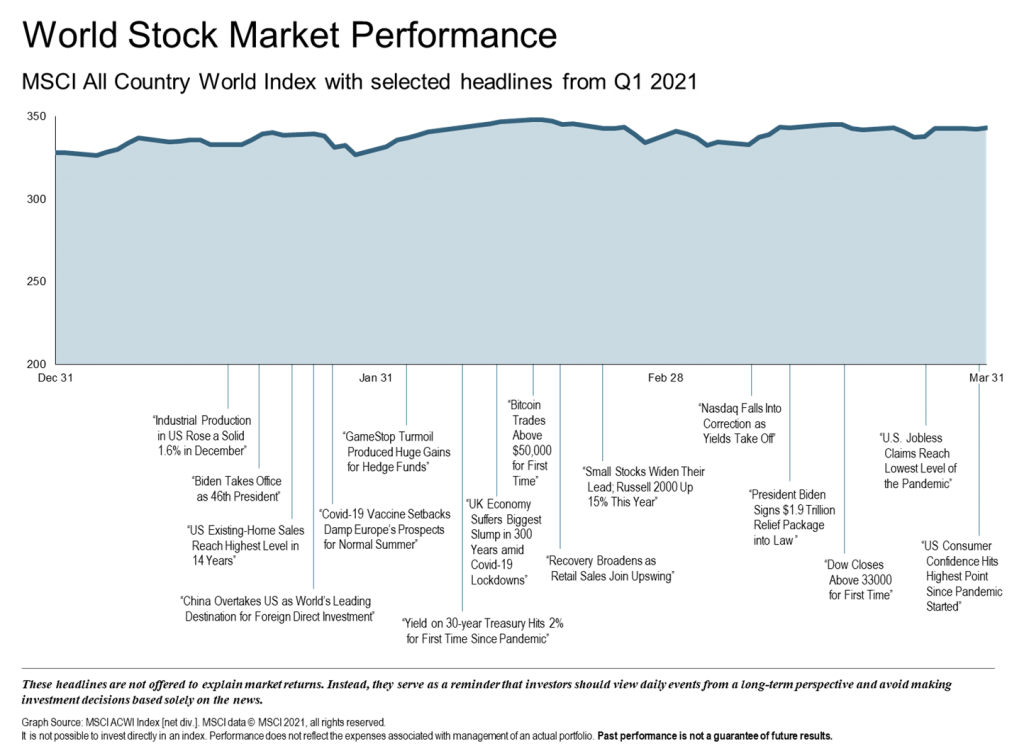

The first quarter of 2021 was a period of transition. A new U.S. president took office, businesses slowly resumed reopening as restrictions eased, and a national roll-out of the COVID-19 vaccine began. Extreme volatility was seen early-on in the quarter when a handful of “meme stocks” (a stock that has an increase in value because of social media hype rather than company performance) made headlines. Capital markets marched steadily higher, reacting to positive vaccine news and the $1.9 trillion fiscal stimulus package passed in March. The Federal Reserve’s accommodative stance, along with an additional $2.2 trillion in stimulus has increased U.S. consumer confidence – at its highest point since the pandemic began.

Global Economy

Global economy recovery continued with variances across regions due to the virus. Central banks in Europe and Japan continued with an expansionary focus, while China has begun to reduce accommodative measures. Europe has had a hard time containing COVID-19 causing ongoing demand concerns. Equity markets around the globe posted positive returns for the quarter. In international developed markets, most currencies depreciated compared to the U.S. dollar, except for the Canadian dollar, the British pound, and the Norwegian krone.

- Developed markets outside of U.S. underperformed U.S. equities

- Developed markets outside of U.S. outperformed emerging markets

- Value outperformed growth

- Small cap outperformed large cap

U.S. Economy

U.S. equities performed well, increasing over 6% for the quarter and up 62% since the low last March. The reflationary tendency continued as did the reversal of asset patterns that were seen in late 2020. Value stocks outperformed growth across large and small cap stocks. The economic reopening boosted profitability for pro-cyclical sectors such as financials and industrials. Interest rate increases diminished the justification for high valuations in the technology sector. Growth and inflation expectations increased Benchmark treasury rates during the quarter. The effect on the bond market was most severe in sectors with the most interest sensitivity. Corporate bonds were also negatively affected by the rate rise, but to a lesser extent. Commodities continued to perform well with oil prices reaching the highest level since late 2018.

Equity Markets

- All asset classes had positive returns

- U.S. Small Value led with an increase of 21.17%

- U.S. Small Cap increased by 12.7%

- U.S. Large Growth trailed with an increase of .94%

Fixed Income

- Interest rates generally increased in U.S. Treasury fixed income market

- Yield on 5-yr U.S. Treasury note rose 56 bps

- Yield on 10-yr U.S. Treasury note rose 81 bps

- Yield on 30-yr U.S. Treasury note rose 75bps

Commodities

- Bloomberg Commodity Index rose by 6.92% for quarter

- Unleaded gas and lean hogs best performers – 28.95% and 27.47% respectively

- Gold and Silver worst performers, decreasing by 9.82% and 7.25% respectively

Looking Forward

2020 was a year of unprecedented economic turmoil, but 2021 has shown early signs of promise. Employment data has improved, businesses are beginning to return to their pre-pandemic norm, and the continued vaccination effort has brought optimism for the year ahead. As the U.S. progresses towards the mid-cycle phase, it is important to remain cautiously optimistic. Monetary policy remains highly accommodative, indicating that rising inflation risk could be a challenge. Policy decisions and the impact on real interest rates are likely to have an increasingly large influence on asset returns. As we move forward and adjust to the post-pandemic landscape, a more inflationary backdrop could be on the horizon.

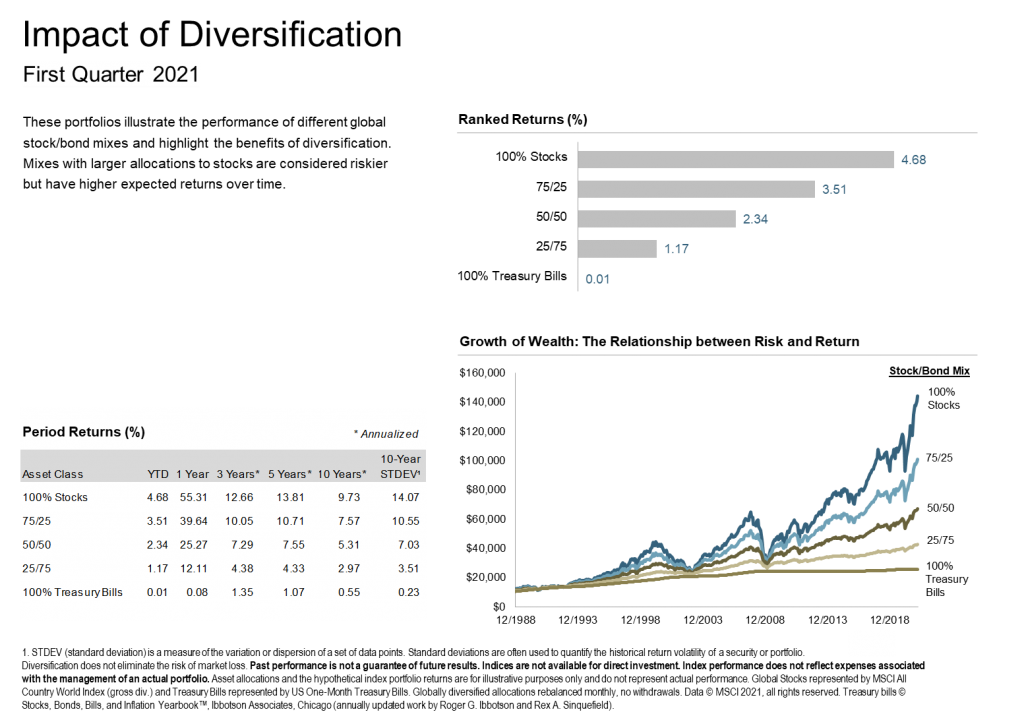

At Paradigm we believe that careful planning and diversification are essential when navigating challenging environments. We approach every individual’s portfolio with a disciplined and emotionless investment approach. As we continue along in 2021, we look forward to providing you with the expertise, perspective, and encouragement you need to realize your financial goals.

The Paradigm Wealth Management Team

References: Fidelity Investments, BlackRock, Vanguard, Reuters, DFA