Q3 Overview

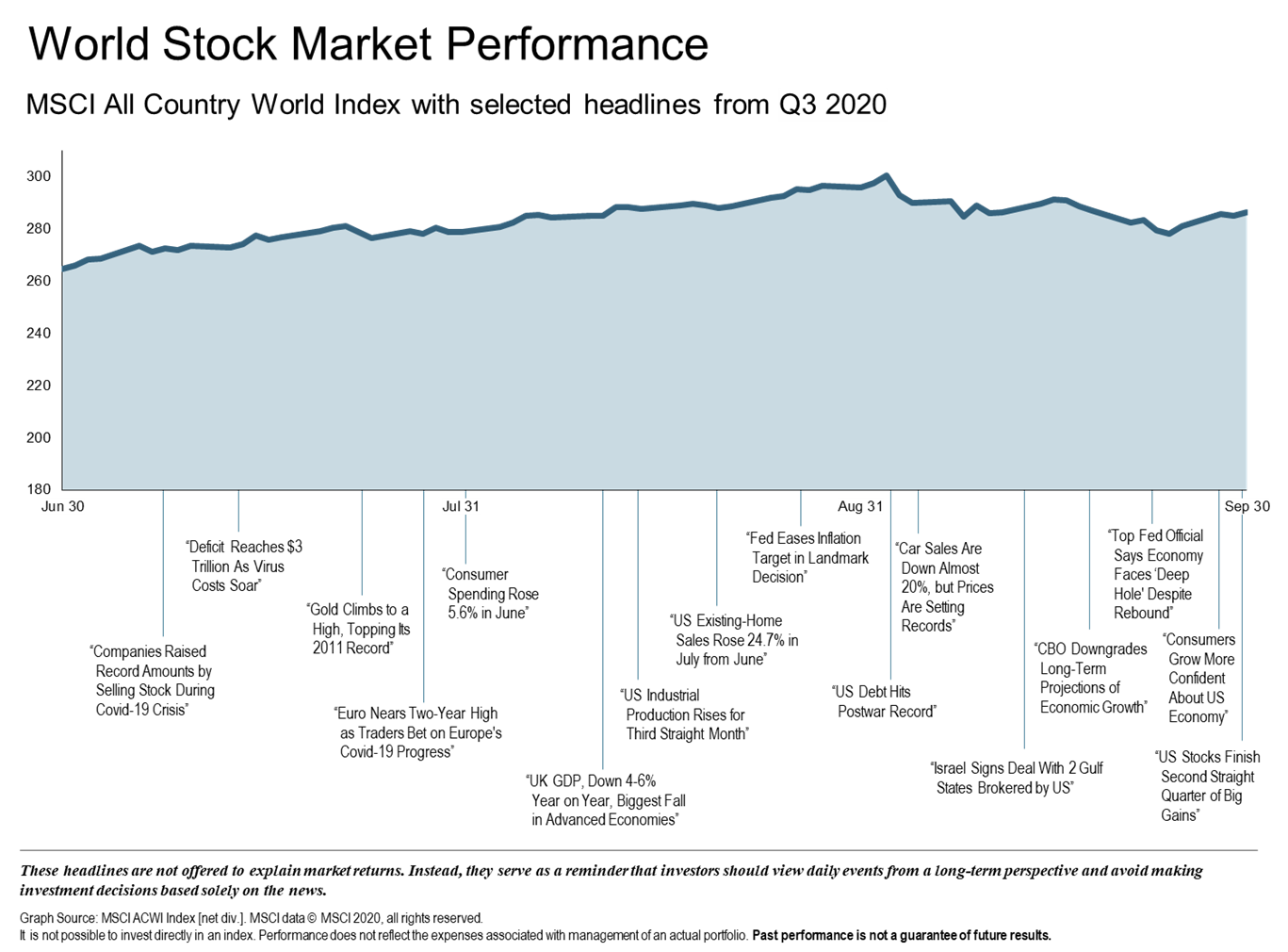

Typically, our quarterly review focuses on the folly of investing based on headlines. Shocks, pandemics, geopolitical upheaval, elections, and the perceived fallout based on these events rarely follow a preconceived formula. One does not have to look too far back in our history to see how predictions have missed the mark (the last election, initial Brexit news, a U.S. downgrade in 2011). With that being said, it’s often hard to avoid the daily headlines, especially in a year like 2020.

During the third quarter of 2020, financial markets continued to rebound from the coronavirus selloff induced in February and March. Most major economies, including the U.S., entered the early cycle phase of recovery, but uneven progress indicates that momentum may remain dependent on the path of COVID-19 and further policy support. This uncertainty indicates potential market volatility as we head towards the end of the year.

Global Economy

The third quarter of 2020 began with investor optimism and continued stock market strength. With the global business cycle in a recovery phase, many capital markets saw positive returns in July and August despite continued pandemic uncertainty. By the end of the quarter, the looming election and uneasiness surrounding the implications of potential stimulus and tax implications induced some market volatility.

Global and fiscal stimulus during the pandemic already far surpass what the world saw after the Great Depression, with $25 trillion in fiscal and monetary stimulus worldwide. Due to a faster reopening, China’s recovery is ahead of most of the world. U.S. and Europe consumer and business confidence have continued to improve helping major economies exit the recession, but activity levels will remain well below normal. Manufacturing continues to rebound faster than services and equity and credit markets continue to shrug off headlines, helping to recoup early year losses.

- Longer term bonds generally outperformed shorter-term bonds

- Global recovery boosted emerging market and small-cap non-U.S. equities

- Uneven recovery

- Uncertainty implies potential for volatility

U.S. Economy

Almost all asset classes posted positive returns for Q3. U.S. growth stocks, including technology and consumer discretionary sectors, had another strong quarter leading to year-to-date gains. It has been a roller coaster of a year with the S&P 500 increasing by 8.9% in the third quarter following a 19.6% drop in Q1 and a 20.5% increase in Q2.

Stock market volatility historically has risen ahead of U.S. presidential elections. Future markets are reflective of the uncertainty that could be prolonged by slower vote counting and potential legal disputes. U.S. 10-year treasury yields remain near record lows due to weak economic activity and quantitative easing and gold and high-quality bonds remain year-to-date leaders. COVID-19 has shifted consumer spending from travel to the purchase of goods, while the housing market has benefited from low interest rates. Although employment conditions continue to improve, permanent layoffs are on the rise. If the pandemic continues to limit reopening, job and activity gains may slow.

Equity Markets

- U.S. stock market increased by 9.2%, increasing 15% between July 4th and early September

- U.S. equity markets outperformed non-U.S. developed markets, but underperformed emerging markets

- 10 out of 11 sectors were positive for the quarter with consumer discretionary (+15.1%) and materials (+13.3%) as top performers

- Value underperformed growth across large and small caps

Fixed Income Markets

- Interest rate changes were mixed in U.S. treasury fixed income market

- Yield on the 5-year treasury note decreased by 3 bps

- Yield on the 10-year treasury note rose by 3 bps

- Yield on the 30-year treasury note increased by 5 bps

Commodities

- Solid returns amid extraordinary monetary support

- Gold was the year-to-date leader

Looking Forward

2020 continues to be an unprecedented year, and for many reasons, that is not likely to change in the short term. The upcoming presidential election has been a hot topic of debate for many months. Historically, political party and tax regime changes have resulted in little discernible market reaction, yet many people continue to consider them important factors in regards to investing. Although both parties often come up with aggressive tax increase/cut and spending increase/cut agendas, these agendas rarely result in predictable market reaction. Although post-election markets have performed positively most of the time, time and again we see that investor perception of the market and economy are directly tied to their political affiliation. Since stock markets historically rise, investment decisions based on political views can be quite punitive.

As we continue our forward march into somewhat unchartered territory, there are some positives to keep in mind. The Fed has established the most accommodated monetary policy in U.S. history. According to Goldman Sachs, consumer spending reached 95% of pre-virus level in late September and the U.S. averaged over 900,000 new COVID-19 tests per day by the end of last month.

Although we remain cautious due to potential market volatility from the unpredictable nature of the current pandemic, we encourage you to move forward with a sense of calm in regards to your financial picture. We believe that prudent diversification and careful planning can help you successfully navigate challenging environments. At Paradigm we look to provide the expertise, perspective, and encouragement to keep you focused on your destination.

The Paradigm Wealth Management Advisory Team

References: Fidelity Investments, BlackRock, DFA