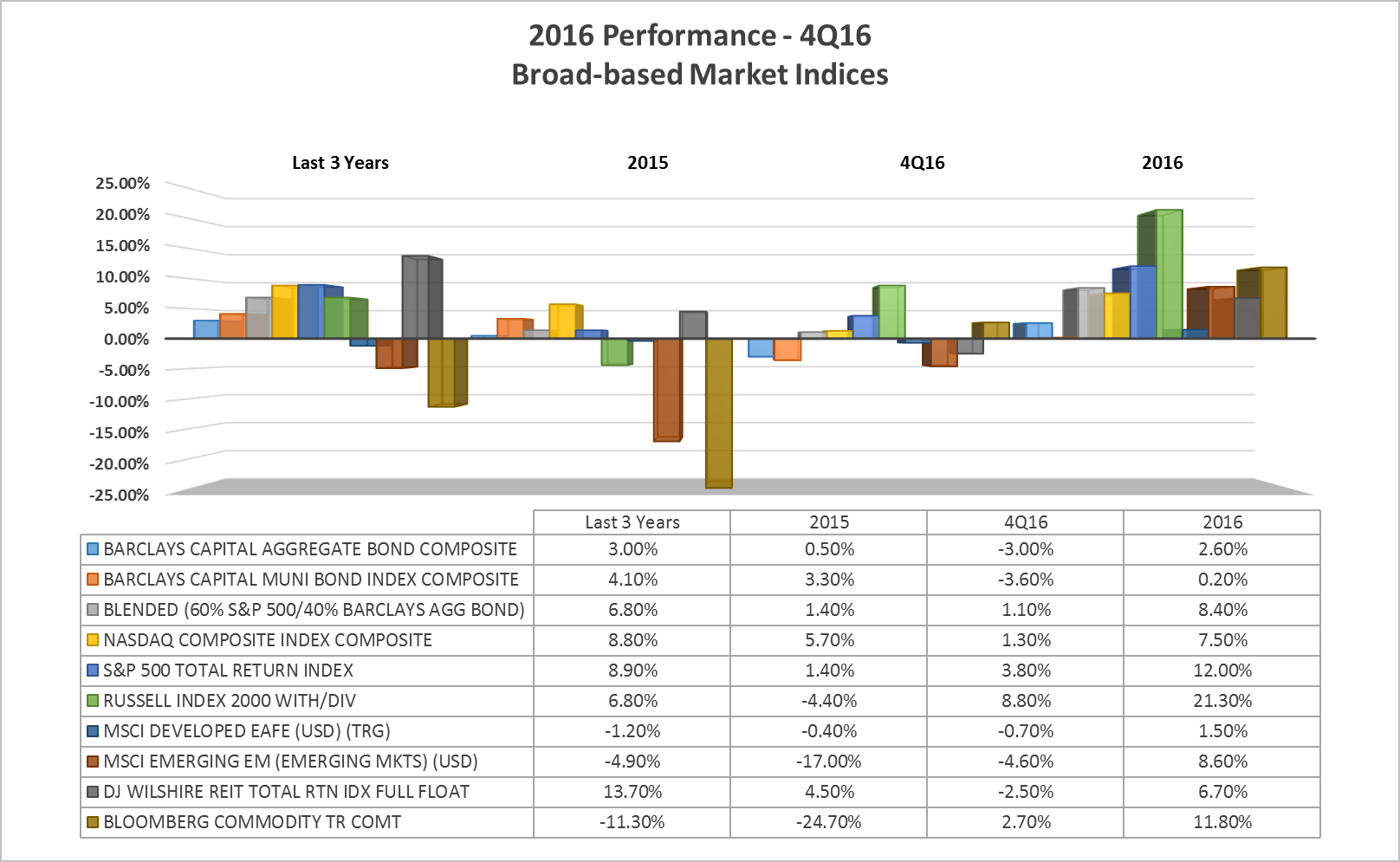

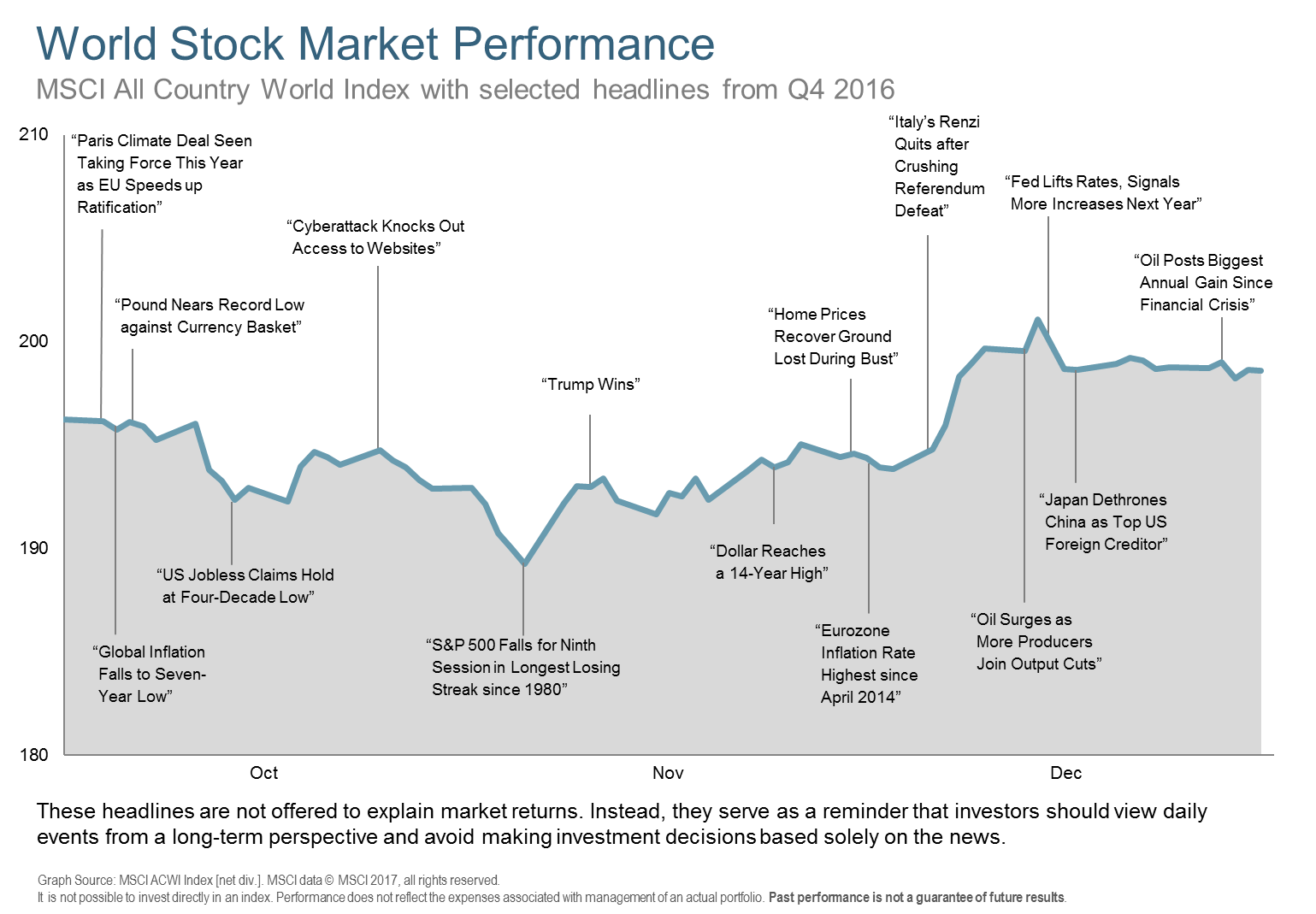

2016 ended on a high note despite a tumultuous start to the year and a few shocks along the way. Throughout the first half of the year, the market experienced some dips due to: a recession scare, worries about a slowdown in China, and nervousness around Britain’s vote to leave the European Union. In late November, we saw the Dow close above 19,000 for the first time ever. In mid-December, the Federal Reserve responded by raising rates for the first time in a year, reflecting optimism about the U.S. economy. After a grim start to 2016, the year ended with the dollar near a 14-year high and oil having its best year since the financial crisis. The broad-based market returns and headline events during the fourth quarter 2016 are depicted in the charts below.

As we move into 2017, the unknown surrounding our newly elected president will likely have an effect on the markets. Assuming the proposed tax cut plan passes through Congress, timing will be important for equity markets. If a tax cut occurs during the first half of 2017, lowering corporate tax rates, there will be incentives to bring cash held overseas home, increasing investment in the U.S. If tax cuts don’t pass until late summer, we may not see the effects until 2018. Reduction in individual rates may raise consumer confidence, therefore positively affecting spending. Proposed rollbacks on some financial and energy regulations, and a repeal of Obamacare may also fuel bank lending, energy investment and job growth for small businesses. The fixed income and equity markets, along with investors, will also be keeping an eye on interest rates and currency fluctuations.

Currently, we anticipate the Fed to increase rates twice in 2017, with a possibility of a third hike. We may see the debate surrounding the reinvestment of proceeds from the Fed’s mortgage-backed holdings come back into focus in 2017 as rate hikes reinforce the trend towards normalization. Treasuries and global rate positions remain expensive. The yield on the 10-Year Treasury note will likely fluctuate between 2.25% and 3.00% in 2017. The range of possible outcomes is wide when you factor in some of the unknowns surrounding major elections in Europe and how President Trump’s proposed plans translate into policy.

In 2016 we saw the dollar ascend to levels not seen since 2003. As we move into 2017, momentum is strong. The dollar looks well positioned to benefit as volatility of the euro increases due to pending European elections. As the Fed tightens policy we will likely see the European Central Back and the Bank of Japan extend stimulus efforts. Volatility is expected from gold and precious metals in 2017 due to a stronger dollar and higher rates in the U.S., while greater U.S. energy production may limit the upside for oil. Currently we are expecting a slow, steady increase in interest rates. If the Fed tightens faster than expected, we may see more uncertainty in the markets. New U.S. tariffs could weigh negatively on global equity markets, and President Trump’s trade policies could lay the groundwork for isolationism, versus globalization. On the other hand, a new era of unilateral (one-on-one) trade agreements, could foster in new, unforeseen areas of growth.

Despite the uncertainties surrounding the recent change of power in Washington, Paradigm Wealth Management remains constant in our commitment to our clients. We will continue to provide clarity and transparency as we work with you to reach your immediate and long-term financial goals.

Resources: Morningstar, WSJ, Google Finance, Fidelity, DFA