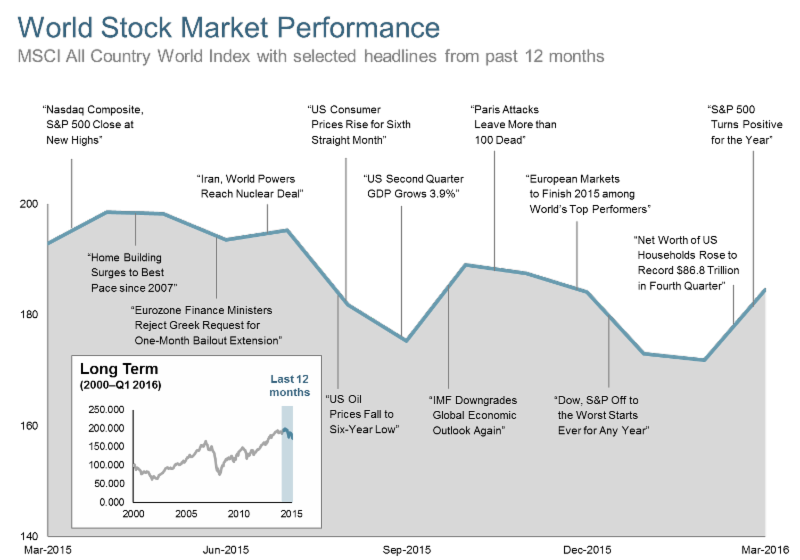

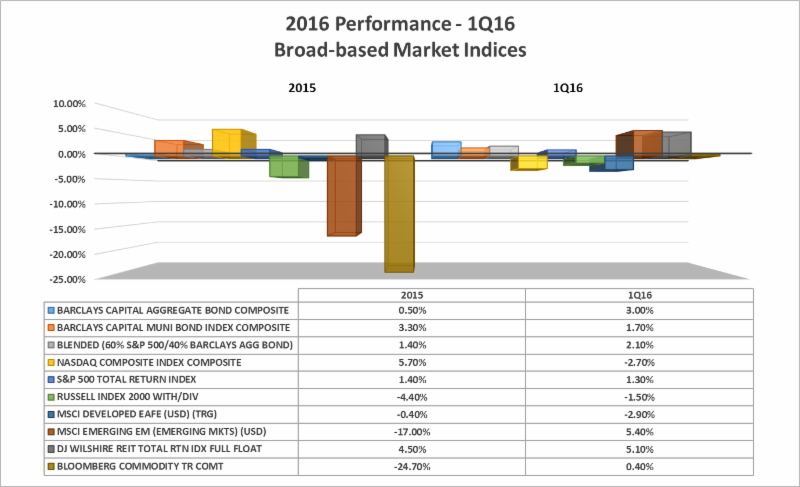

Q1 2016 ended slightly positive from where it started. If you weren’t paying attention though, the accumulated returns were not a smooth sideways line to the end, but very much a deep shaped “U” as depicted below. Similar to a rollercoaster ride, there were emotional moments during the middle of the quarter, that brought 2008 and August 2015 flashback memories to investors. Apprehension around China’s growth, a strong U.S. dollar’s impact on emerging markets, premature rate hikes by the Federal Reserve, repercussions of continued low oil prices, and negative interest policies in Japan and Europe, culminated in a 10%+ sell-off in global equity markets and speculative or risky junk bonds by February 11th. However as you can see a rapid reversal followed, resulting in a profitable return by March 31st. Quality fixed Income counterbalanced the ride by increasing, against all predictions, as investors flocked to U.S. Treasuries and high quality corporate bonds as a safe place for investing. Global fixed income markets also responded favorably as Japan and Europe continued their aggressive easy monetary policies. Commodities and oil which ended quite negatively in 2015, seemed to bottom mid-way throughout the quarter, ending positively. REIT’s in a similar pattern sold off initially, only to come strongly rebounding back.

Realization that the U.S. economy was not about to fall into recession, a bottoming of oil prices, stimulative and stabilizing policies implemented by China, and a pause in interest rate hikes by the Federal Reserve, all helped reverse the new year sell off. Not only did the U.S. central bank not raise rates another .25% as had been speculated earlier, but softened its stance on near term future tightening.

Although, we are 8 years into an economic recovery and generally rising markets, (with the exception of commodities), there are few forecasts of a pending recession due to the age of this expansion. The positives influencing the consumer, including relatively low interest rates, low oil prices, a growing job market and decreasing debt levels support the argument. However, there is consensus thinking for continued volatility, or rollercoaster type periods in all global markets as the Fed unwinds an unprecedented stimulus program, Europe continues its recovery, China and other emerging nations become more balanced consumer driven economies, and deflation/inflation remain at moderate levels. All easier said than done, and thus the markets will continue to react with anxiety as these dynamics evolve.

This newsletter is meant to give you a high level snapshot summary of the quarter’s activity and trends for the future. We always invite questions and conversations at a more detailed level about how markets are affecting you and your family’s financial goals and plans. We would like to continue to re-emphasize, our readiness, to help steer you through the inevitable changes as they occur.

Resources: Morningstar, WSJ, Google Finance, Fidelity, DFA