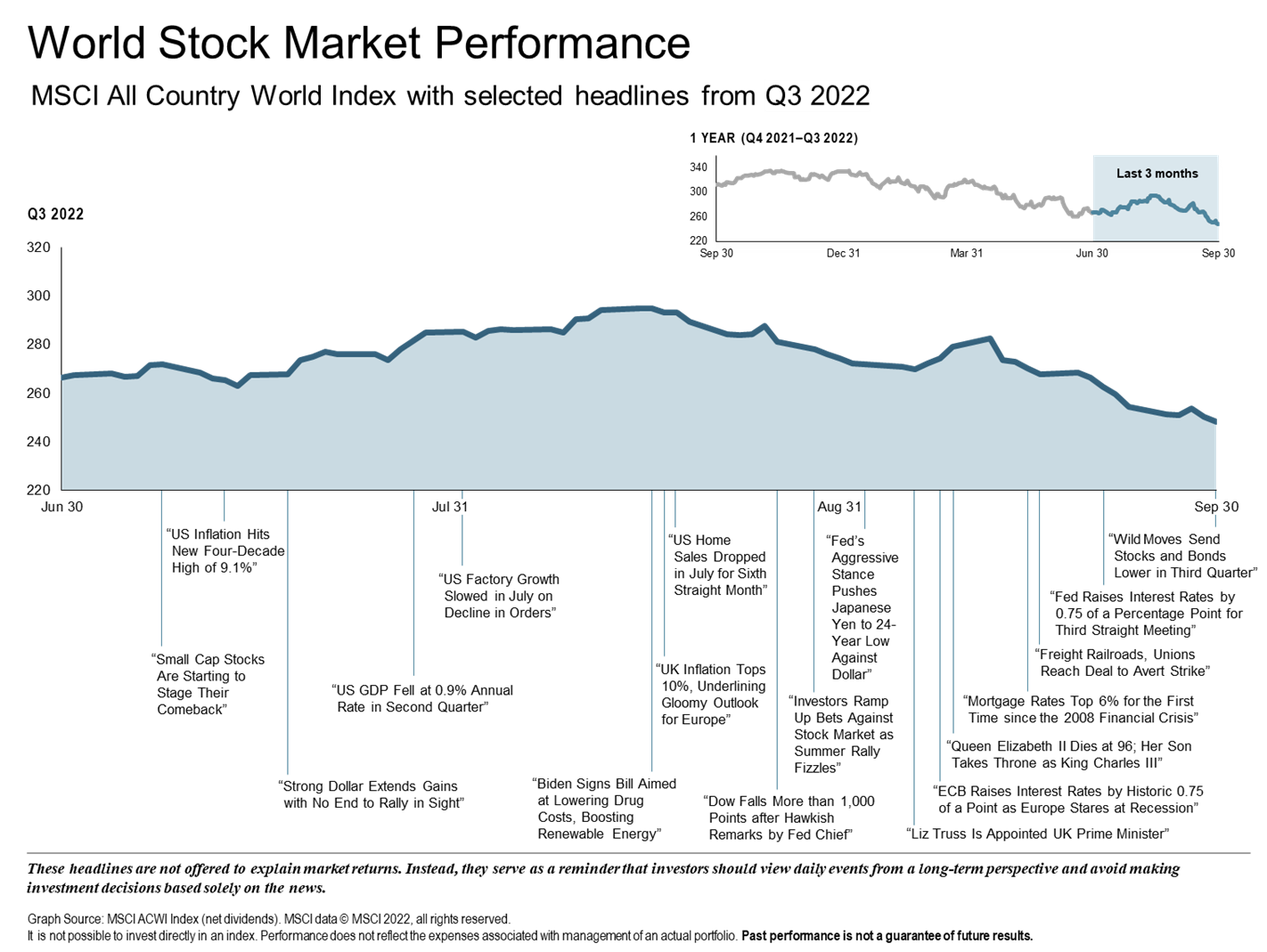

Investors have navigated a trying market all year and the third quarter was no exception. Although the quarter began with optimism, with solid corporate earnings and signs of inflation slowing, this thought was short-lived. A shockingly high inflation reading in August prompted the Federal Reserve to announce its intent to continue to fight inflation by keeping interest rates higher for longer. This message was reiterated when rates were raised 75 basis points in mid-September with expectations of another .75% hike in November and a .50% increase in December. Stock and bond markets have been extremely volatile, driven by the ripple effect of decades-high inflation, aggressive interest rate increases by most central banks, and the rising risk of a recession.

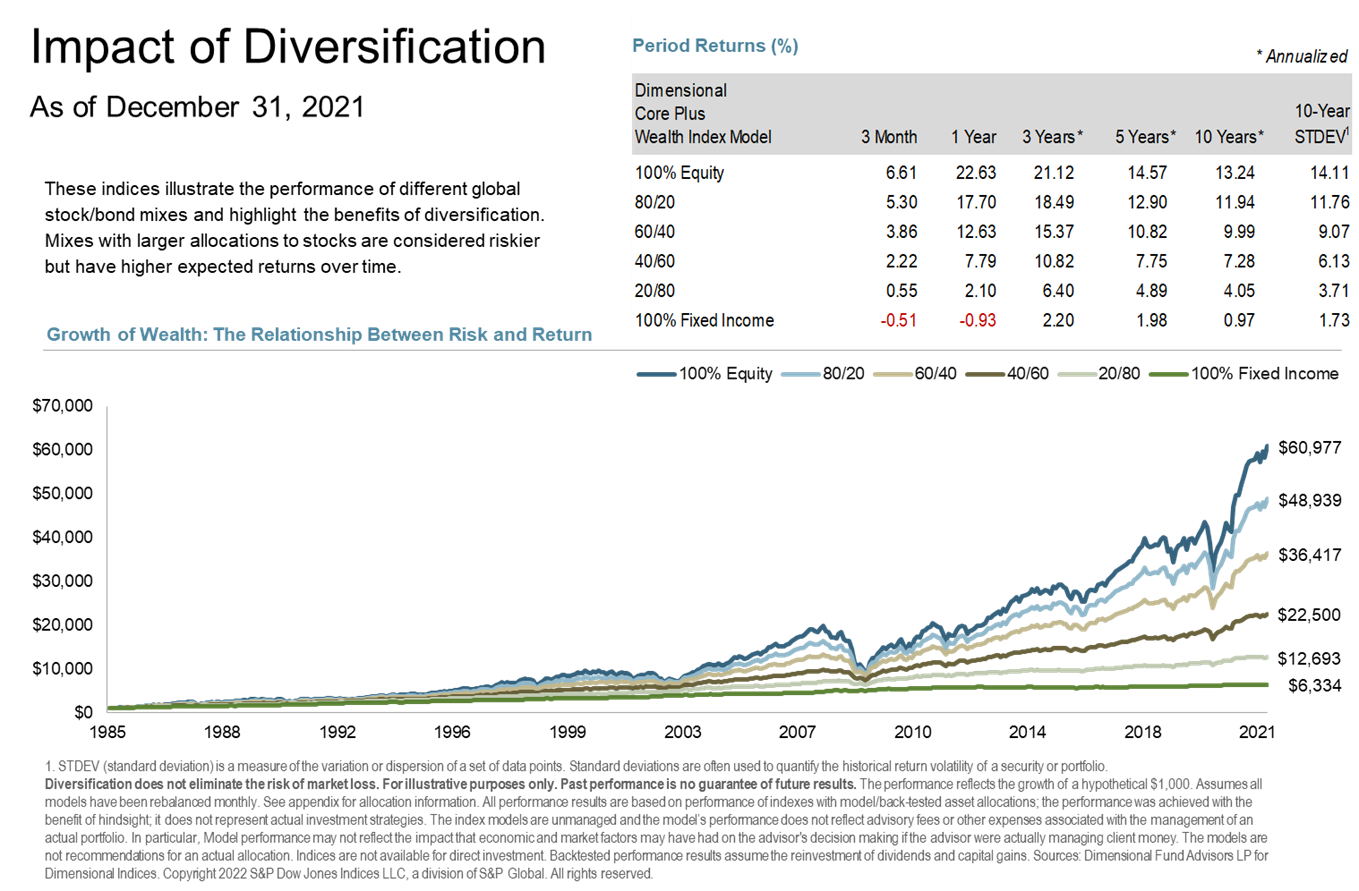

Although in times like these it is common for investors to want to wait until they feel comfortable to invest, it is important to remember that while bear markets are unpleasant, they create opportunity for long-term investors. Investing not only involves risk, but it requires risk. History shows that those who have the discipline and courage to withstand market corrections are often rewarded. A well-diversified portfolio is the best strategy in both bull and bear markets. By remaining steadfast in a long-term investment plan investors can look forward, focusing on their future growth potential rather than the recent volatility they might see in the rear-view mirror.

Global Economy

This year continues to be a tough one worldwide. Stock markets around the globe have continued to struggle during Q3. International developed markets have underperformed the U.S. market but outperformed emerging markets. Geopolitical tensions remain as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and persisted with nuclear threats. In addition, China continues to fight declining growth and continued COVID lockdowns, which is affecting the overall returns of emerging markets.

- International Developed -9.2% for quarter, -23.91% for year

- Emerging Markets -11.57% for quarter, -28.11% for year

- Elevated recession pressure, especially in Europe

U.S. Economy

The U.S. is in the late-cycle expansion phase. Although U.S. profit growth remained positive, it is decelerating. U.S. equities were negative for the quarter but outperformed international and emerging markets. When stocks are down, investors typically look to bonds for support, but have not found a safe haven as rising rates tend to push bond prices lower. This unusual sequence of events has resulted in even the most well-diversified portfolios experiencing negative returns. Labor markets remain tight with a low labor-force participation rate and aging demographics contributing to a demand for wage increases. The current outlook is that market volatility will remain due to slower liquidity growth, continued inflation risk, greater monetary policy uncertainty, and slowing growth momentum.

Equity Markets

- -4.46 % for quarter

- -17.63% for year

- Up 11.39% over 10 years

Fixed Income

- Inverted yield curve

- S. Bond Market -4.75% for quarter, -14.6% for year

- Yield on 5-Year U.S. Treasury Note increased to 4.06%

- Yield on 10-Year U.S. Treasure Note increased to 3.83%

Commodities

- Commodity Total Return Index down 4.11%

- WTI Crude Oil and Unleaded Gas Worst performers

- Natural Gas and Corn best performer

Looking Forward

While the first three quarters of the year have been disheartening for investors, it is important to maintain perspective over the past few years. Last year saw some of the best returns as the world emerged from the pandemic. Overall, markets are mostly positive since 2020 and the S&P 500 has gained over 40% since the beginning of 2019. It is important for investors to remember that markets never move in a straight line and not to overreact to short-term setbacks.

As we begin to close out 2022, the ongoing situation between Ukraine and Russia, mid-term elections, and uncertainty surrounding inflation all have the potential to disrupt the markets. Studies over decades have proven that it is impossible to time the top or bottom of a market cycle. We at Paradigm Wealth Management are here to ensure that you have a well-thought-out portfolio plan. We continue to monitor developments closely, periodically rebalance assets as necessary, and remain focused on the long-term success of each of our clients. Our doors are open for a conversation. Please don’t hesitate to reach out!

The Paradigm Wealth Management Team

Sources: Fidelity Investments, BlackRock, DFA, Vanguard, Officialdata.org