Q3

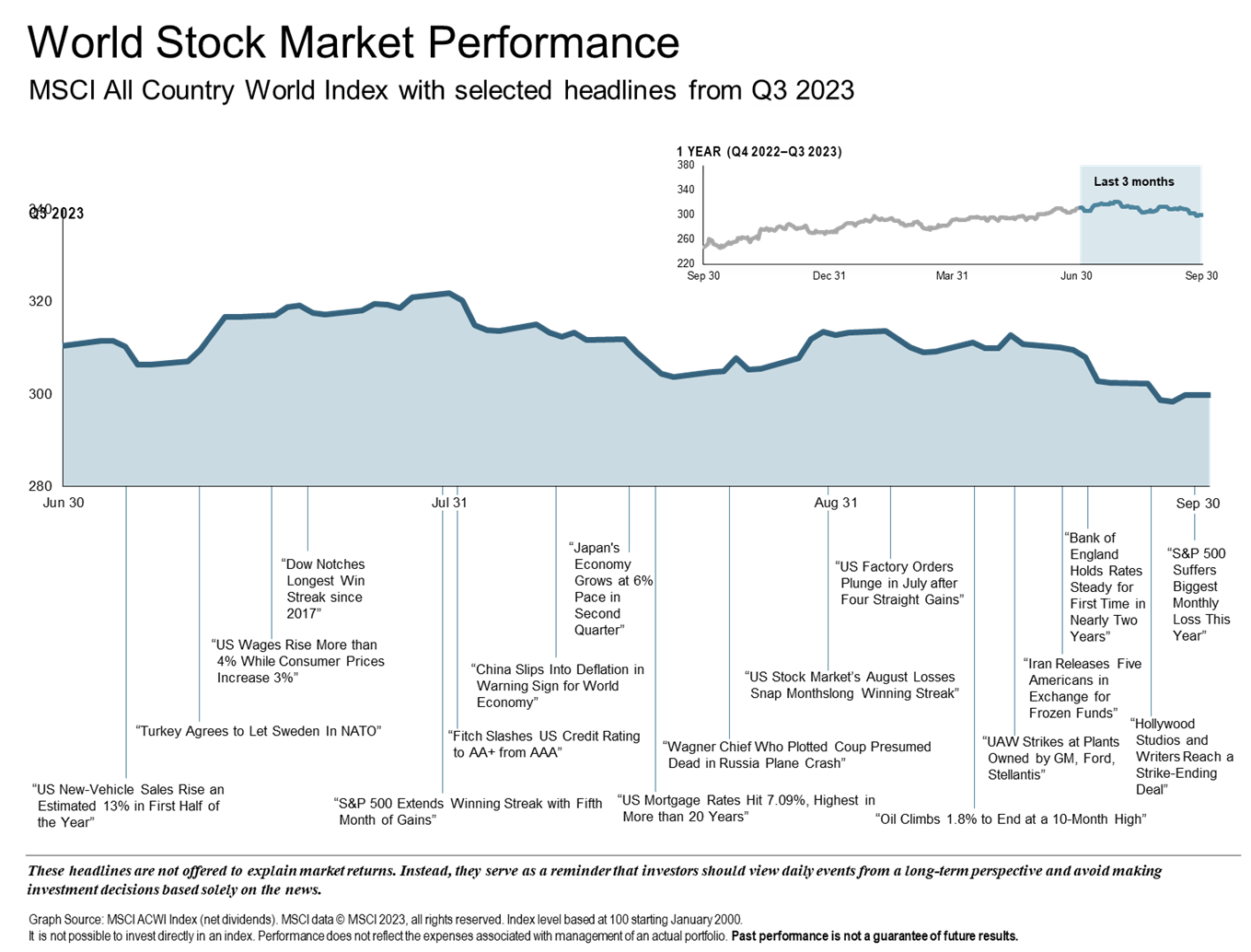

Historically, the third quarter of the year is often tainted by volatility and Q3 of 2023 has been par for the course. The optimism that drove the stock market rally during the first half of the year, has been replaced with uncertainty as analysts predict that the Federal Reserve will adopt a “higher for longer” strategy. The “Magnificent Seven” stocks that provided the market with most of its gains during the first and second quarters retreated, while value and energy stocks were the top performers. Amid concerns of another rate hike, bond markets continued to struggle. The Bloomberg U.S. Aggregate Bond Index is on track for an unprecedented third straight year of losses. Although momentum is slowing as the Fed strives for a soft landing, there are several positives to keep in mind. Economic growth has surpassed expectations, consumers have remained resilient, and core inflation has shown a continued downtrend since peaking 11 months ago.

Global Economy

While the resilience of the U.S. economy has exceeded economists’ expectations, the situation overseas is less optimal. With the exception of the U.K. and Australia, interest rates increased across global developed markets. High inflation has continued in the Eurozone, increasing pessimism for 2024. GDP growth has fluctuated between -.1% and .1% while Central Banks face the challenge of balancing slower growth with above-targeted inflation. Facing structural challenges including a deflating real estate bubble, China’s economic growth is also struggling. Developed markets outside of the U.S. posted negative returns and underperformed both U.S. and emerging markets.

- Value outperformed growth with marginally positive returns

- Small and large cap stocks both had negative returns

- Growth stocks performed the worst returning -8.24%

U.S. Economy

The U.S. economy is continuing its steady progression through the late-cycle phase. GDP growth is estimated to be higher than expected at around 4%. Consistent with many challenging July through September periods, the S&P 500 fell 3.3% during the third quarter. Despite the recent decline, it remains positive, increasing 13.1% YTD. The Energy sector was the standout this quarter, rising 12.2%, primarily driven by the increase in oil prices. Sectors that are inflation sensitive, specifically Utilities and Real Estate trailed, with Utilities experiencing the steepest drop, -9.2%. Consumer spending has remained resilient with solid job growth and rising wages; however this trend may be impacted going forward as the laggard effect of monetary tightening coupled with higher energy prices may weigh on consumer spending. Inflation has significantly declined from 9.1% in June of 2022 to 3.7% in August of 2023 while the labor market remains tight but is moving towards a better balance.

Equity Markets

The equity markets experienced a downturn this quarter due to persistent inflation fears, returning -3.25%. As we move closer to earnings season, announcements are anticipated to affect stock performances.

· U.S. equity market outperformed non-U.S. developed markets

· Small cap stocks underperformed large cap stocks

Fixed Income

Interest rates increased across all bond maturities in the U.S. Treasury Market for the quarter.

· The yield on the 5-Year Treasury Note increased to 4.6%

· The yield on the 10-Year Treasury Note increased to 4.59%

Commodities

The Bloomberg Commodity Total Return Index increased 4.71%.

· Lower Sulfur Gas Oil (up 43.22%) and Heating Oil (up 39.15%) were best performers

· Wheat (-20.02%) and Kansas Wheat (-18.32%) were worst performers

Looking Forward

Although the details in our market commentary typically include information through the end of the previous quarter, we feel that the recent conflict between Israel and Hamas should be mentioned. First and foremost, the potential effect that this has on the economy is secondary to the human tragedy that has taken place. Today’s world economy is vulnerable. As the globe continues to struggle with lingering effects from the pandemic and Russia’s war in Ukraine, this unpredicted shock has the potential to further disrupt the world economy. According to the World Bank President Ajay Banga, “Having war is really not helpful for central banks who are finally trying to find their way to a soft landing”. As a crucial supplier of energy and a key shipping passageway, conflict in the Middle East can result in more expensive oil, higher inflation, and slower growth. How widespread this conflict becomes will determine the magnitude of the disruption.

At the conclusion of Q3, estimates for the fourth quarter and 2024 show encouraging signs of robust earnings and energy growth. Seasonality favors stocks with the fourth quarter typically outperforming the first three quarters of the year, but there are some headwinds that require caution including: the resumption of student loan repayments, depletion of pandemic-induced savings, and the lagged impact of high interest rates. In addition, the trajectory of inflation will continue to be influenced by energy prices.

There are a lot of unknowns in the world right now and plenty to worry about. Historically, when investors become concerned, their natural tendency is to sell risky assets. However, trying to time the market is a mistake. Looking at the last 50 years, on average, buying at a confidence peak returned 3.5% while buying at a trough returned 24%. At Paradigm Wealth Management we actively monitor each of our clients’ portfolios. Invested in your best interests, we remove emotion from the equation, ensuring that your investments align with your long-term goals. Thank you for your continued trust in our services.

The Paradigm Wealth Management Team

References: Fidelity Investments, BlackRock, Vanguard, New York Times, Morningstar, Bloomberg, FactSet, Standard & Poor’s and University of Michigan.