2023 in Review

After a challenging 2022, 2023 began with investor concerns about inflation and a potential recession on the horizon. Throughout the year, market sentiment proved to be more mercurial than normal. Recession fears and a regional banking crisis in Q1, resilient growth over the summer, a “higher for longer” message from the Fed in Q3, and a year-end indication that rate cuts are nearing sum up the roller coaster ride. Despite investor concerns and the Federal Reserve raising rates four times throughout the year, the stock and bond market experienced a much-needed comeback which was bolstered by a solid economy, better than expected corporate earnings, and an apparent end to the Fed’s interest rate hikes. Although a handful of mega-cap stocks dominated performance early on, that all changed in November when investors became more confident that the Fed had stopped raising rates. The December rally was more broad-based, with 90% of stocks in the S&P 500 trading above their 50-day moving averages. As we head into 2024, analysts predict that the next few months will be critical for the Fed and the economy.

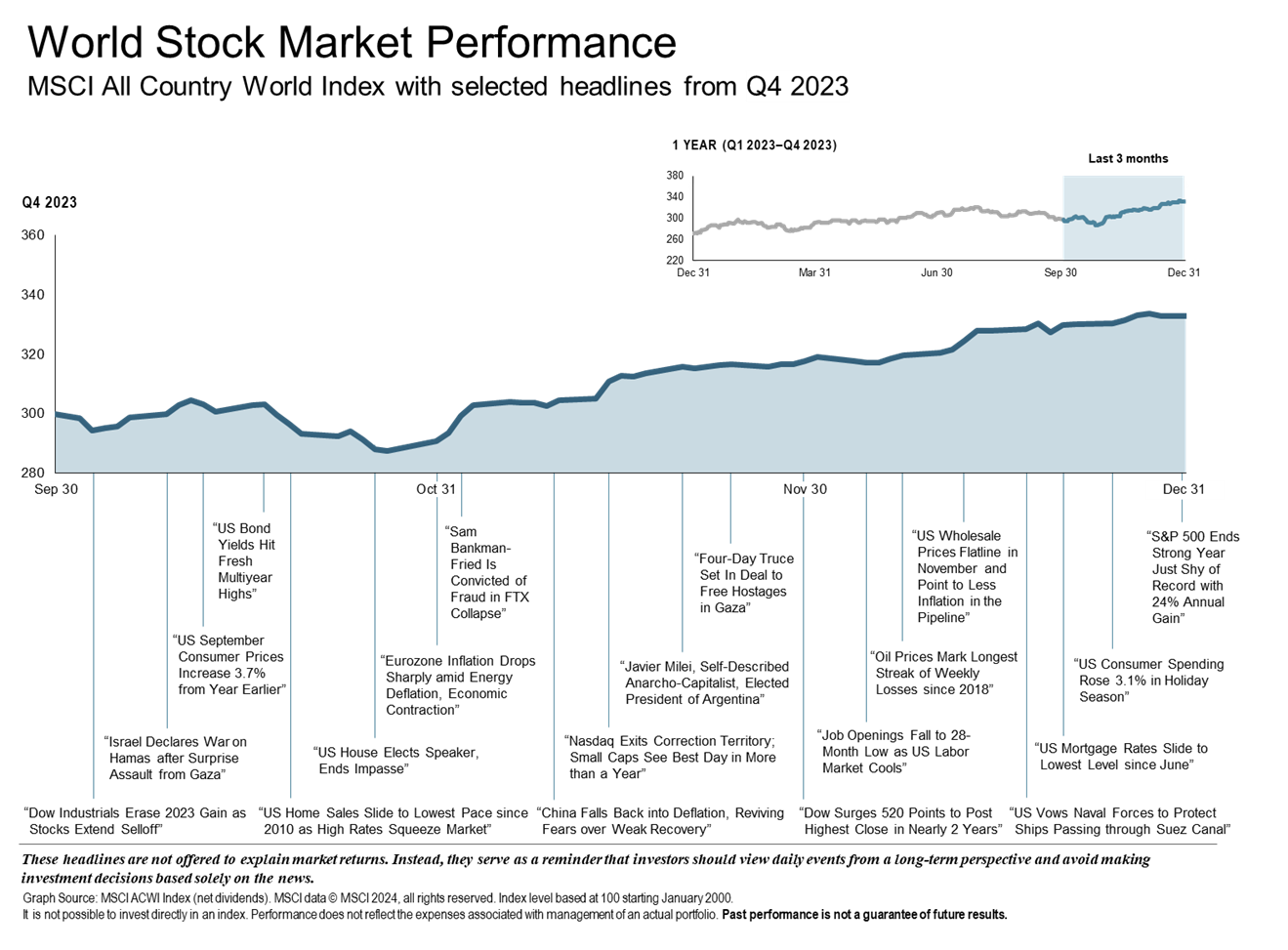

Q4

After a dismal Q3, 2023 ended on a positive note. Equity markets experienced positive returns while the Bloomberg U.S. Aggregate Bond Index avoided the anticipated and unprecedented third straight year of losses. Falling inflation and the expectation that central banks will end rate hikes eased worries. The S&P 500 closed out the year on the brink of an all-time high and, largely due to investor enthusiasm for AI technology, the Nasdaq Composite’s return was one of its best since 2009.

Global Economy

The fourth quarter was strong in many regions around the globe. Developed markets outperformed emerging markets amid ongoing worries about China’s real estate sector. Most sectors within the Eurozone experienced positive returns with the expectation that interest rate increases have subsided. The Euro area annual inflation rate fell in November to 2.4%, down from 10.1% a year prior. The UK equity markets also experienced positive returns, with UK small and mid-cap indices outperforming the broader market as investors were encouraged that interest rates may have peaked. The Japanese market experienced significant volatility over the quarter but ended positive to close out the year. Taiwan, South Korea, and India saw the most robust growth in Asia, while emerging markets finished positive for the quarter despite China continuing to be a drag on broad EM performance. Latin America finished the quarter strong with an asset market increase of 17.1%.

According to the Bloomberg Global Aggregate indices, the final quarter of the year marked the best performance for fixed income markets in over two decades. A perceived shift in monetary policy from a “high for longer” stance to progressive rate cuts was the major driver of performance. Government bond yields fell while credit markets rallied, outperforming government bonds.

U.S. Economy

The U.S. economy has defied expectations. Despite pessimistic expectations at the start of 2023, economic growth has progressed at a significant pace over the year, driven by strength in consumer spending, a revival in manufacturing structures investment, and an increase in state and local government purchases. Job growth remained steady while the unemployment rate stayed low. Inflation decelerated, in-part due to post-pandemic supply chain improvement, and investor concern eased.

Equity Markets

After a 10% market correction between July and October, better than expected inflation data and dovish remarks from the Fed resulted in a bull run for equity markets in Q4. Core inflation decelerated but remained well above the 2% target while stock and bond prices both rose. An “everything rally” resulted in the strongest return in November for the S&P 500 since 1980 as well as the strongest November return for the Bloomberg Aggregate Bond Index since 1985. The Fed’s remarks in December supported a continued rally indicating that inflation and Fed policy are the main drivers of yields and asset markets.

-

- U.S. Large Cap Growth topped the leader board, for quarter (14.1%) and year (41.2%)

- Growth outperformed value stocks

- Small cap stocks increased 14%, after lagging for the first 9 months

- S&P 500 gained 11.7%

Fixed Income

-

- U.S. Aggregate Bond Index posted a positive return of 6.8%

- U.S. 10-year Treasury Yield declined by .69%

- U.S. 2-year Treasury Yield declined by .79%

Commodities

It was a challenging year for commodities. The group finished down 12.55% due to numerous factors including rising interest rates, recession fears, and China’s disappointing post-pandemic reopening. The decline in commodities contributed significantly to disinflation in emerging markets. Energy and oil experienced the steepest decline in Q4, while precious metals performed the best.

Looking Forward

Although inflation is trending downward, there is concern that the market may prove stickier than anticipated. As we head in to 2024, inflation and the Federal Reserve’s next move continue to be prime concerns. A couple scenarios to consider that could threaten the momentum seen in late 2023 are, 1.) the Fed needs to retract its message about rate cuts as pivoting too soon, could threaten its progress on bringing core inflation down or 2.) most of the soft-landing narrative that we have been hearing about may already be priced into the market, leaving little room for further gain. Historically, during the time between the last interest rate hike and the first cut, stocks and bonds typically rally, but in the 6 months post first interest rate cut, bonds usually outperform stocks.

Shifting long-term trends in economic conditions such as record-high debt and aging demographics may create fiscal and monetary policy challenges. In addition, unstable geopolitics and peaking global integration may dictate a change in direction from recent decades regarding policy conditions. 2024 will be a pivotal election year in the U.S. as well as globally. International policy, inflation, and social issues will be on the minds of voters. Election years often bring volatility to the market, but for long-term investors, who wins the election has little impact on returns.

We at Paradigm Wealth Management remain steadfast in our philosophy. Current inflation, profit, and policy risks make strategic diversification more important than ever. Our goal is to understand what is important to you. We invest with a purpose and aim to provide consistency in an uncontrollable world. Your trust is of utmost importance to us. Thank you for your continued confidence. We look forward to continuing to serve you in 2024!

The Paradigm Wealth Management Team

References: Fidelity Investments, Morningstar, Bloomberg, Forbes, Dimensional.