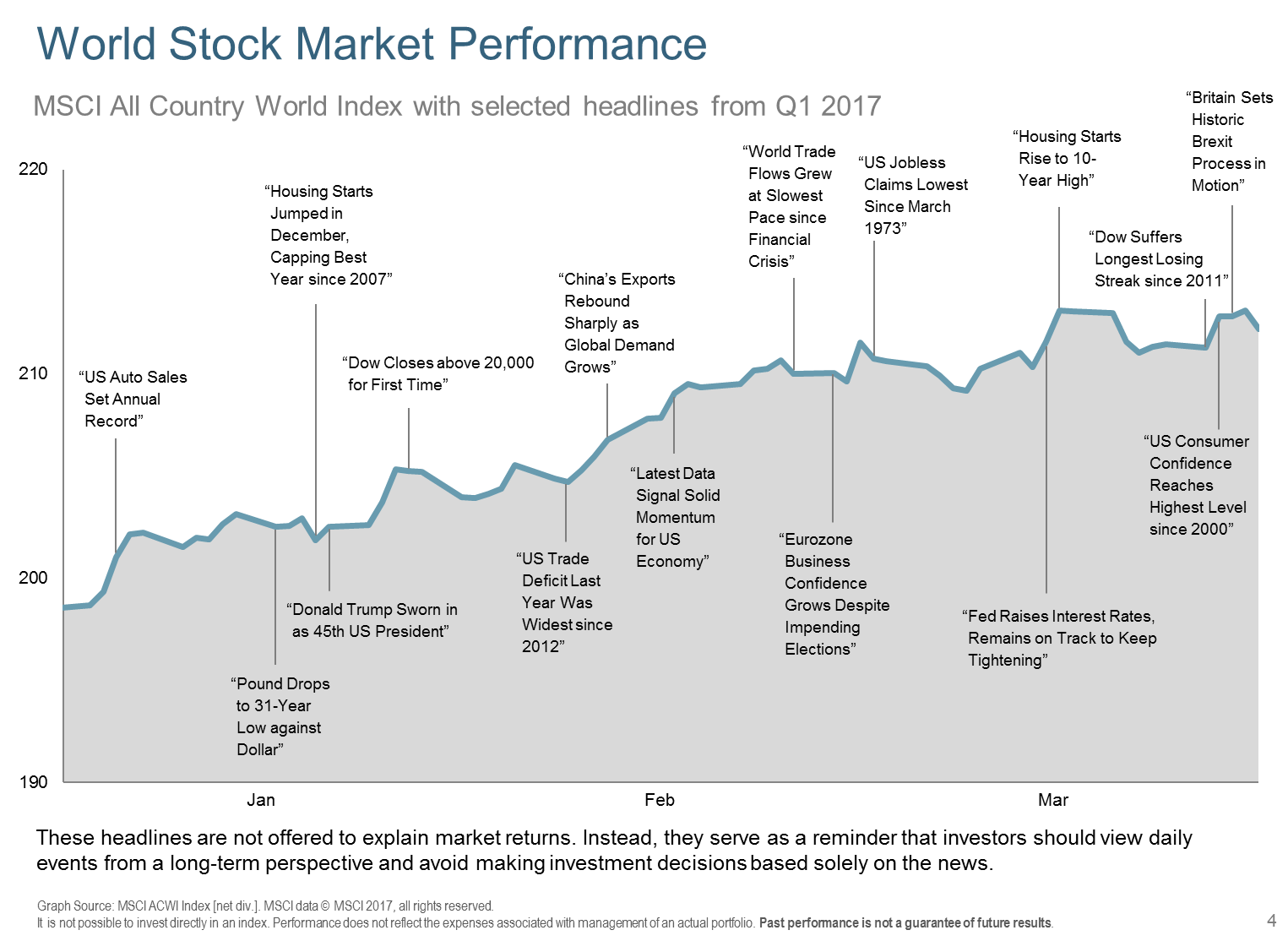

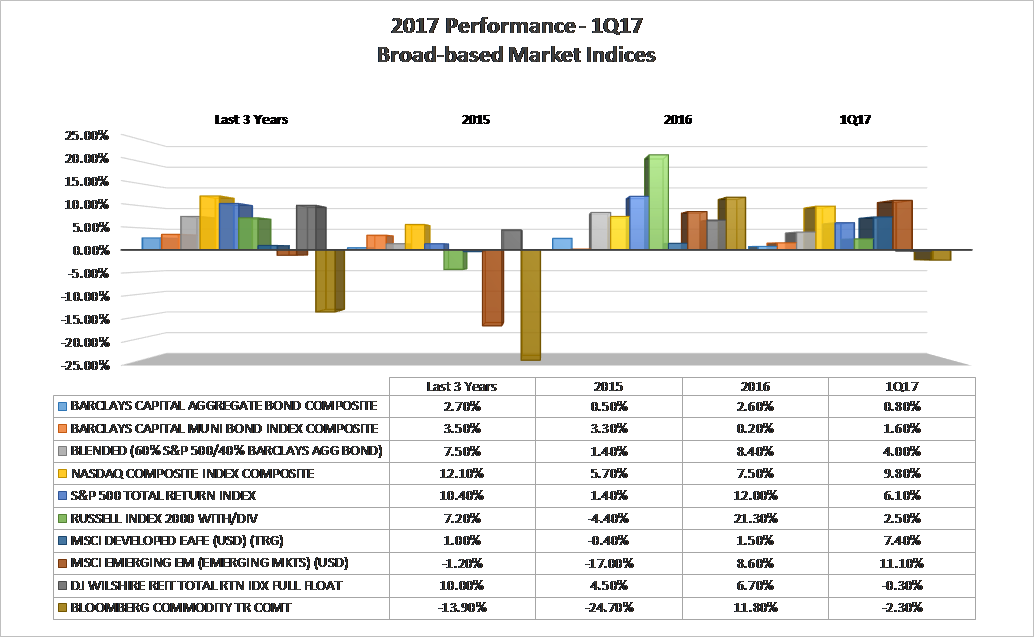

Global Markets continued their march higher in Q1 of 2017, overshadowing the daily political headlines of the new U.S. administration, and populism concerns in European elections. Both domestic and international stocks and bonds increased as seen below, with emerging markets equities pushing past U.S. large cap equity performance on a one-year basis for the first time in years. Although some of the rally was a continuation of post-election optimism for new domestic growth policies, different sectors were responsible for taking the lead this quarter. Financial and industrial type companies which soared in the Q4, handed the baton over to companies in technology and growth sectors. International and emerging stocks were bolstered by a weakening dollar, softer rhetoric on trade from the administration, stable to improving China, and continued accommodative language from the European Central Bank. Although the continued rally was a surprise to many, the lack of volatility was the most puzzling, with very few pullbacks throughout the quarter. The S&P 500 posted an average swing of .3172% in the first three months of 2017, making the quarter the quietest since the Q3 of 1967.

Long-term Treasury yields, which are driven by the outlook for growth and inflation, declined modestly, giving a slight boost of return, once again, for the quarter (prices rise as rates decline). This was in sharp contrast to the post-election results, which saw the 10-year U.S. Treasury yield soar to 2.60% at one point. The bell weather treasury closed 3/31, at a yield of 2.39%. At the same time, short term yields rose as the Fed announced an increased quarter percentage target of the Fed Funds rate mid-March, with expectations to raise rates again throughout the year. Higher short term rates with lower long term rates is referred to as a flattening of the yield curve. Many thought this phenomenon occurred due to the realization that tax cuts and fiscal stimulus touted by the administration would take much longer to execute by Congress, than originally thought. Concerns of too much inflation from these policies subsided. This also helped boost returns for riskier, interest rate sensitive sectors within the bond market, including preferred, high-yield and emerging market-type debt.

Alternative income investments were a mixed bag. Global oil inventories are in better balance between supply and demand than at any time during the past two years with the price of oil stabilizing around $52/barrel. However, with U.S. fracking producers able to add easily to supply, the chance for more near-term price upside may be limited. REIT’s, which sold off at the end of the year on rising interest rate fears, stabilized in Q1 for reasons mentioned above regarding bonds. Commodities eased slightly with moderating inflation expectations.

Looking forward, many are anticipating Q1 GDP numbers and corporate earnings to support the rally that’s been fueled on by feelings of optimism and positive sentiment. The Fed has signaled the time is right to begin normalizing interest rates and is expected to wind down their $4.5 trillion size balance sheet of mortgage-backed securities and treasuries acquired during the financial crises. With the economy on more solid footing, the central bank hopes to allow the balance sheet to shrink to a more neutral size in a way not disruptive to their targeted short term interest rate policy. The yield curve continues to flatten, with longer term rates continuing to decline. This may be in disagreement with the stock markets positive view of the economy, or a flight-to-safety reaction from recent strong U.S. administration rhetoric with North Korea, Russia and Syria. Globally, geo-political events as well as upcoming elections in France (May), Britain (June) and Germany (Fall 2017) could affect the recovery now in place.

In closing, a respected assessment by Fidelity Investments, believes the global economy is experiencing a synchronized expansion, and risks of recession now, are low. However, potential unknowns surrounding the harmonized growth story undoubtedly exist and will unfold. As always, we are here to help you make sense of the delicate complexity and interconnectedness of global markets and their place in your diversified portfolio strategy and financial plan.

References: JP Morgan Strategy Team, Fidelity Investments, Fidelity Cycle Board, WSJ, Morningstar, DFA.