2024 in Review

As we reflect on 2024, many investors may ask, “what happened”? The year began with understandable investor concern about inflation and the Federal Reserve’s next move. Apprehension surrounding whether the so called, “soft-landing” had already been priced into the market, leaving little room for continued growth, shifting trends in economic conditions such as record high-debt and aging demographics, as well as geopolitical turmoil and the volatility that often accompanies an election were common discussion points. Yet, despite analyst expectations that drastic rate cuts may be required to counter the expected fall in growth, as base rates in the U.S. were over 5%, while the treasury was trading at 3.8%, this scenario never materialized.

Why? Three themes come to mind – economic strength, a reshaped treasury yield curve, and global equity earnings trends.

Economic Strength – The U.S. consumer market as well as the labor market were remarkably resilient. Continued spending across the across goods and services helped the U.S. Gross Domestic Product to surpass its long-term average, while low unemployment and steady hiring have boosted the labor market, helping to support household finances. This, in combination with moderating inflation, powered the U.S. stock market to new highs.

Reshaping the Yield Curve – In 2024 we saw a significant divergence in short-term and long-term interest rates, causing the yield curve to “normalize”, resulting in a higher yield for long-term bonds than short-term bonds.

Global Equity Earnings Trends – The “Magnificent 7” stocks in the U.S. led the charge in powering equities higher across the globe. The S&P 500 saw gains of 25%, the NASDAQ Composite, driven by strength in technology and communication services, grew 37%, the Dow Jones Industrial average returned a positive 16%, and the Russell 2000 saw an 18% gain.

To sum up 2024, the economy found a balance between growth, stability, and opportunity. While 2025 will undoubtably bring about a new mix of risks and concerns, the underlying strength of the U.S. economy should encourage investor optimism.

Q4

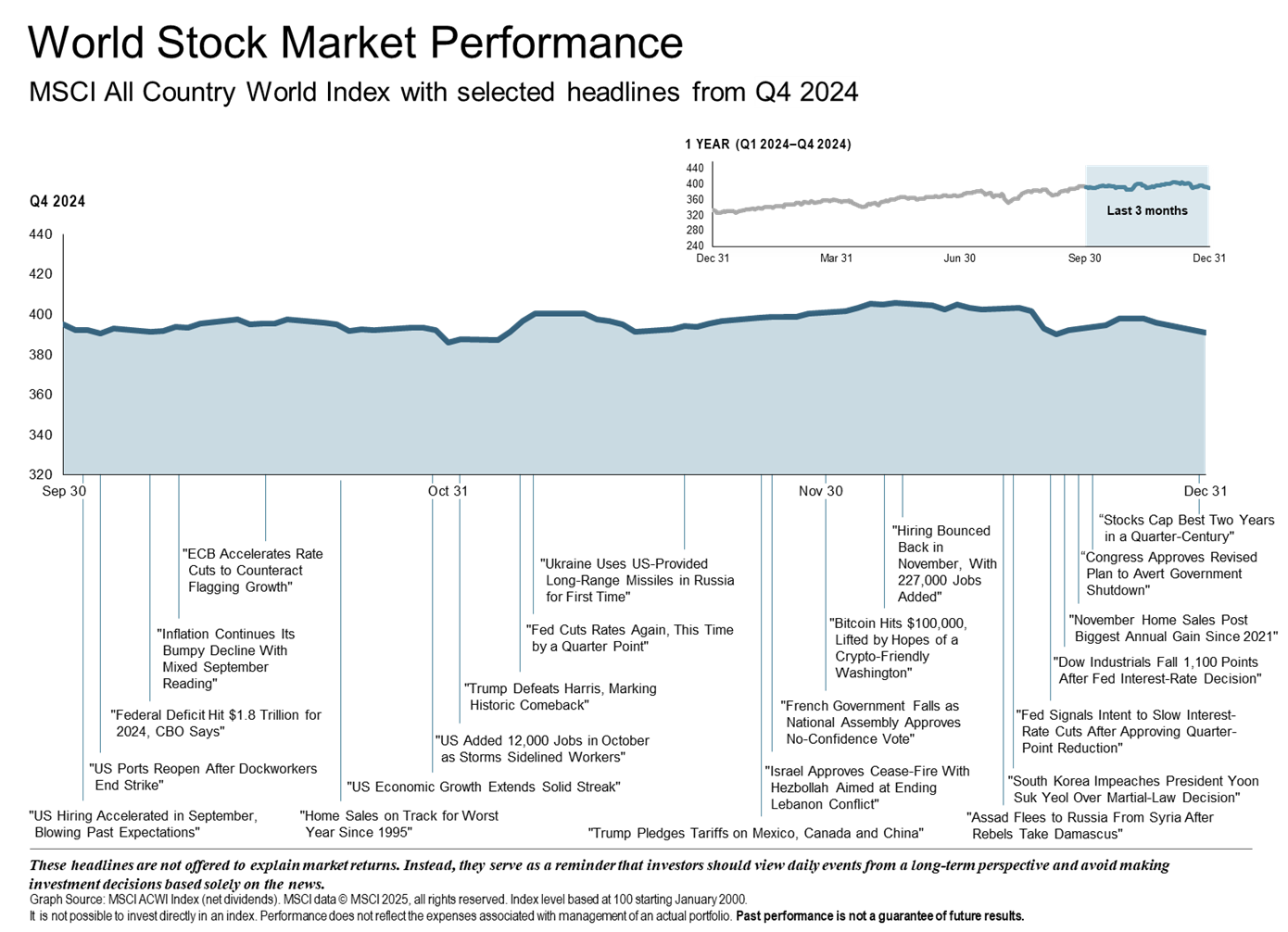

U.S. stock market performance was mixed among asset classes during the final quarter of 2024. Communication services, information technology, and consumer discretionary spending performed the strongest while materials was the weakest sector. The Fed lowered interest rates 25 basis points in November and December, however its announcement that interest rates would be scaled back (from 8 cuts to 2) in 2025 triggered a market sell-off in December.

Global Economy

Outside of the U.S., economic data have remained mixed. Many economies have struggled trying to achieve strong growth in combination with decreased inflation that the U.S. has realized. Although inflation is close to target in the euro area, this has come at a price of stagflation due to weak external demand, a decrease in productivity, and the lingering effects of an energy crisis. China’s economy ended 2024 better than expected following stimulus measures put in place to meet its growth target. The economy expanded by 5.4% in the fourth quarter, beating analysts’ predictions, but the threat of a trade war with the United States and weak domestic demand could dampen further recovery this year. After a weak start to 2024, Japan has recently experienced a more favorable growth dynamic with rising wages and consumption growth.

International developed and emerging markets declined in Q4 with the MSCI ex USA IMI Index down -7.5% and the MSCI Emerging Markets IMI Index down -7.9%. Globally, most countries posted negative returns with the exception of the United States, Taiwan, and Singapore. Interest rates generally increased across developed markets. In the UK, Germany, Canada, and Australia, the short-term segment of the yield curve remained inverted.

Most analysts predict the recent soft patch in global economic activity to continue into 2025 but agree that fiscal policy remains supportive stating that the decline in inflation will boost real incomes and easing price pressures will allow most central banks to normalize interest rates in the months ahead.

U.S. Economy

The U.S. Economy ended 2024 on a high note with business activity in the services economy increasing towards the end of the year. Higher than expected GDP growth in Q3 (3.1%) and a strong PMI (Purchasing Manager’s Index) reading for December point to a strong start to 2025. The PMI has now recorded continual growth since February 2023, with the closing months of the year ending favorably following the Presidential Election.

Equity Markets

Equity markets rallied post-election in anticipation of deregulation, corporate tax cuts, and increased infrastructure spending, but optimism dwindled in December as proposed tariffs and strict immigration policies spurred investor fear. Despite the volatility, U.S equities gained 2.4% as measured by the S&P 500 (a 5-quarter streak of positive returns).

-

- Growth continued to outperform value stocks

- Large cap stocks outperformed small cap stocks

- Some of the Magnificent 7 stocks continued to perform strongly

Fixed Income

-

- Interest rates generally increased

- U.S. 10-year Treasury Yield increased by 77 basis points to 4.58%

- U.S. 2-year Treasury Yield increased by 59 basis points to 4.25%

Commodities

Commodities struggled in Q4. The Bloomberg Commodity Total Return Index returned -0.45% for the quarter but returned a positive 5.38% for the year. Sugar and Nickel were the worst performers for the quarter while coffee and WTI crude oil had the highest returns.

-

- Sugar was down -14.29%

- Nickel was down -13.81%

- Coffee was up 18.51%

- WTI crude oil was up 7.10%

Looking Forward

Sometimes looking back brings perspective to our thoughts moving forward. Two years ago, a volatile year had just wrapped up and pessimism abounded. Stocks and bonds fell double digits in 2022, a recession seemed imminent, and the Fed projected that bringing inflation back to normal would come at the loss of 1 million jobs. Since then, the U.S. economy has continued to grow with rising productivity, and a public and private sector investment boom. We currently have a healthy labor market, the Fed’s credibility is high, and earnings for U.S. companies are expected to grow at 10% over the next two years. New technology cannot be ignored as the large tech giants operate on a scale that was impossible in the past and it seems that we are just beginning to see the impact of AI applications. This is the first time since the late 1990s that we have had two consecutive years of 20% gains.

This positive economic backdrop is a nice way to head into 2025, but as always, it is important to keep in mind that there are unknowns that inject risk into the market. New leadership in government could lead to policy changes including tax reform, tariffs, and new regulations. Additionally, monetary policy and Fed decisions are fluid, and can change dramatically over the course of a year. Most analysts project more modest gains for 2025.

If nothing else, reflection on the past should bring perspective to the future. Our goal at Paradigm Wealth Management is to help our clients avoid making emotional investment decisions while we continue to focus on changes in the market. As a boutique firm, we take pride in our ability to assess each of our clients’ unique situations and assist them in making sound portfolio decisions that align with their personal goals. We look forward to continuing to work with you in 2025!

The Paradigm Wealth Management Team

References: Fidelity Investments, Morningstar, Bloomberg, Forbes, Dimensional