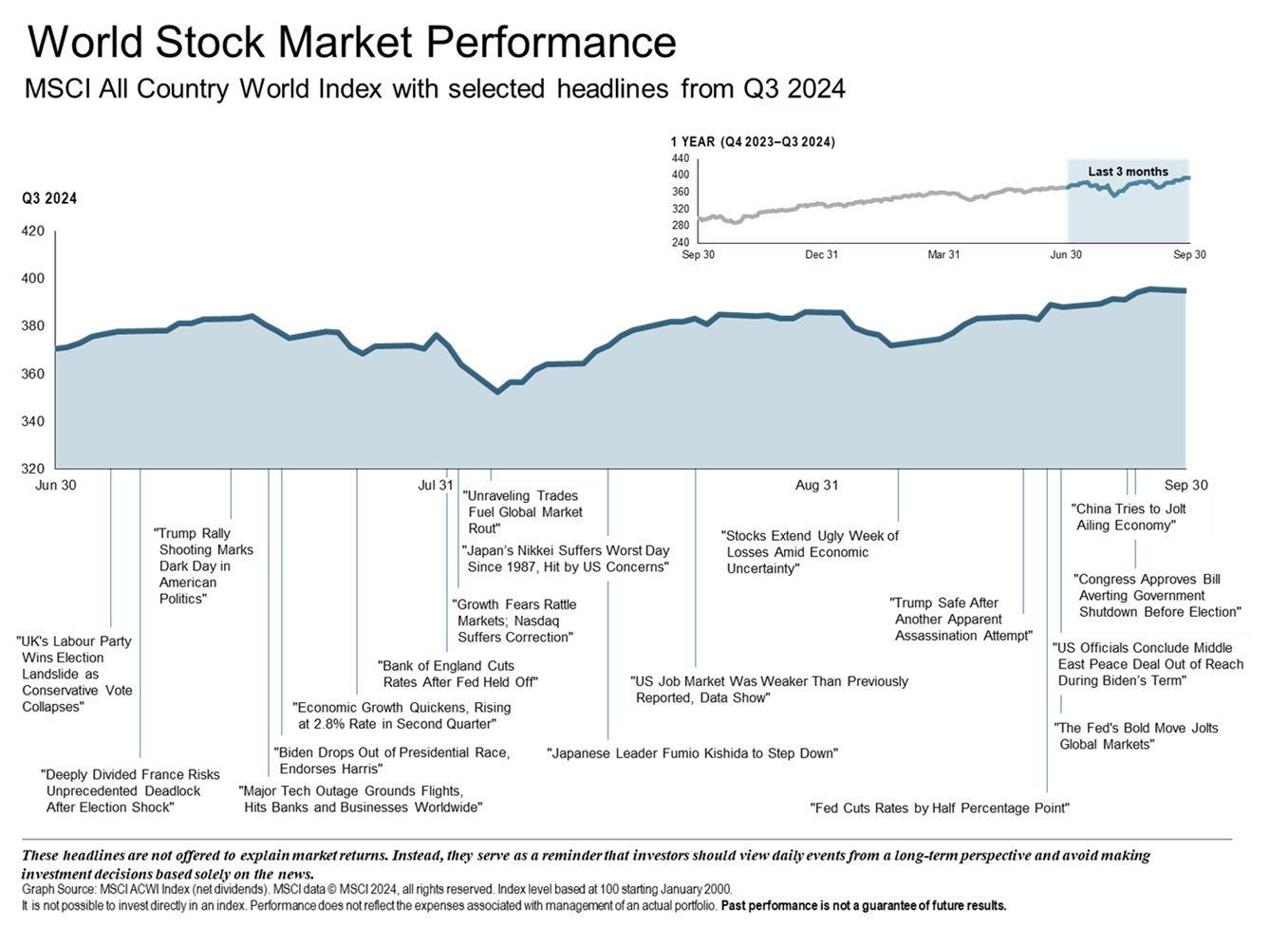

The third quarter for the markets was nothing short of extraordinary. Despite a brief dip in early August due to some weaker-than-expected U.S. manufacturing and non-farm payroll data released in July, the markets have continued their upward trajectory. Market broadening as a result of earnings growth across sectors is a healthy sign and has been an important factor in the positive trend. In September, the U.S. Federal Reserve started a new easing cycle with a larger-than-usual half-percentage point reduction. This decision was met with enthusiasm from investors who see this as an indication that the long-term growth trend can continue. At the conclusion of the quarter, U.S. stocks saw the 3rd best start to a presidential election year since 1928 with a return of 19.5% compared to the average 8.2% in an election year.

Global Economy

Global equity markets continued to rally throughout Q3. The European Central Bank announced their 2nd rate cut in September, coordinating a global easing cycle with the Fed and most other central banks. Although many emerging markets, including Chile, the Philippines, The Czech Republic, and Mexico, followed suit, Brazil was the exception, raising its policy rate to 10.75%. The U.K. also held steady but is expected to announce a rate cut in November. The Bank of Japan surprised the market by raising rates, resulting in a stronger yen and provoking a sell-off of Japanese equities. Due to sluggish demand, concerns surrounding deflation in China have continued. After five consecutive quarters with a negative GDP deflator, China’s target of 5% economic growth may not be met.

-

- International Developed and Emerging Markets outperformed U.S. Equity Markets with a return of 7.76% and 8.72% respectively

- Value outperformed growth

- Small caps outperformed large caps

- 1-year long term market increase summary – International Developed 24.98%, Emerging 26.05%, Global Real Estate 30.43%

US Economy

The U.S. Economy experienced stronger-than-expected growth during Q3. The GDP grew at an annualized rate of 4.9%, the strongest growth in almost two years. Robust consumer spending, high business investment, and lower interest rates have helped retain optimism amongst investors. Encouraging news from the Fed in September stating that restrictive real rates, not a stalling economy, are driving their rate reductions has positively impacted the market. U.S. inflation data continues to make progress towards the Fed’s long-term target of 2%.

Equity Markets

The bull market continued during Q3 but there was a shift away from the Magnificent 7 driving the growth. Economists feel that the broadening in equity returns among companies other than large tech is a positive trend. The end of the quarter marked the S&P 500 closing at an all-time high with utilities and real estate the leading sectors. Although the U.S. market underperformed the International Developed and Emerging Markets, it returned a positive 6.23% and remains the 1-year long-term leader, increasing 35.1%.

-

- Notable rotation in market leadership favoring small cap, value, and real estate

- Utilities (positive 18.5%) and Real Estate (positive 17.2%) were sector leaders

Fixed Income

Interest rates decreased in the U.S. Treasury Market for the quarter. Bonds rallied as the interest rate cuts and the chances of a soft landing solidified. Investors found the most return in long-term core bonds and treasury bonds. As the Fed began their much-anticipated easing cycle, the yield curve normalized after more than two years of inversion. Economists predict that shorter-term bond yields will continue to fall as the Fed cuts rates, but long-term core bonds and treasury bonds are not predicted to do as well.

-

- S. Bond Market increased 5.2%

- Global Bond Market excluding U.S. increased 3.48%

Commodities

Commodities are up 5.86% YTD with a 4.86% increase in September. The third quarter returned mixed results with soft commodities leading gains and energy declining. Overall, The Bloomberg Commodity Total Return Index returned a .68% gain for Q3.

-

- Coffee and Lean Hogs were the best performers, returning 21.17% and 12.70% respectively

- Heating oil and Sulphur Gas Oil were the worst performers returning -16.51% and -15.72% respectively

Looking Forward

Despite concerns surrounding the Fed’s decision on interest rates and the durability of growth, the third quarter of 2024 ended on a high note. The economy remains fundamentally strong, with higher-than-expected GDP growth and an unexpectedly large number of jobs created in September. The election season may bring about some volatility, but traditionally does not have a lasting impact on the markets. The S&P 500 has only lost money in four election years including: 1932 (The Great Depression), 1940 (World War II), 2000 (The Tech Bubble), and 2008 (The Great Financial Crisis). Conflicts in Ukraine and the Middle East remain risks to the economy as does trade policy.

There is never a time when risks to the market do not exist, but they are much reduced when investors have a diversified long-term investment plan in place. Sitting in cash the last couple of years has left a lot of return on the table. Looking back at 2023, stocks returned 26.3%, U.S. bonds 5.5%, and money market funds 4.7%. Similarly, 2024 returns YTD have been 19.5% for stocks, 3.1% for bonds, and 2.8% for money market funds. On the opposite side of the risk spectrum, chasing individual stock performance is incredibly risky. Over the last 5 years, 64% of individual U.S. stocks have made money, while 36% have lost money compared to 99.9% of stock mutual funds and ETFs returning positive numbers.

We, at Paradigm Wealth Management, feel privileged to have earned your trust. During rough times as well as calm we continue to closely monitor your portfolio, striving to mitigate risk and maximize performance. We consider your individual goals when constructing a portfolio that aligns with your short and long-term plans. As a small firm, we take pride in our ability to focus on personal relationships. Please don’t hesitate to reach out if you have any questions.

The Paradigm Wealth Management Team

References: Fidelity Investments, Morningstar, Bloomberg, Forbes, Dimensional.