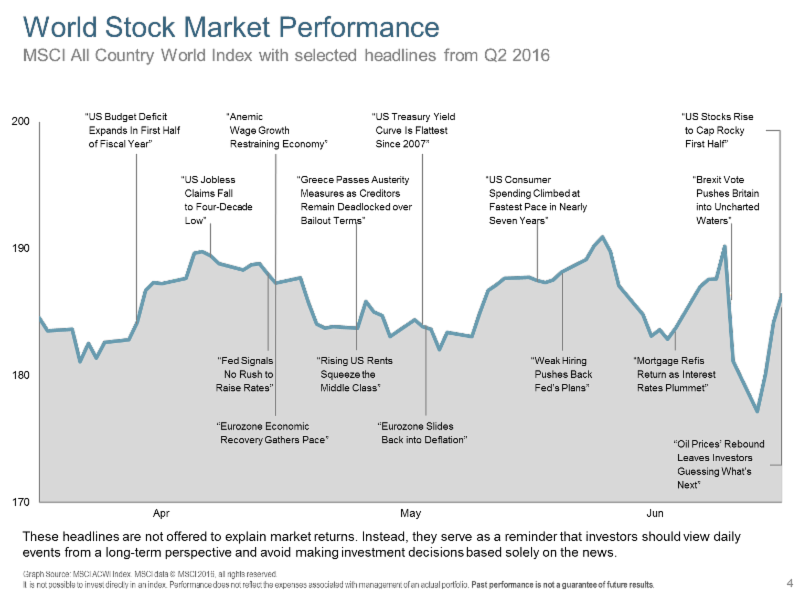

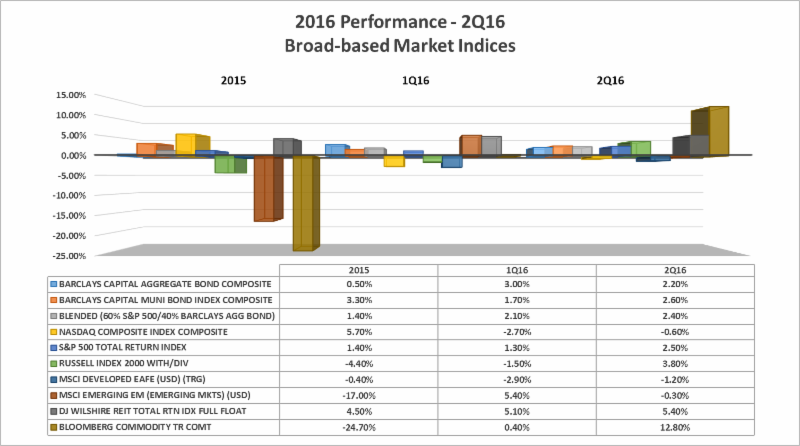

Returns for U.S. stocks and bonds ended positive for the second quarter ending June 30, 2016. International and emerging market stocks ended slightly negative. The biggest event of the quarter was England’s vote to leave the European Union (BREXIT) which surprised world markets. Per the chart below, investors saw significant volatility around that event!

Bond markets, both domestically and internationally, rallied which pushed yields down once again as investors sought safety from a volatile stock market. Global central banks reinforced a period of low rates and ample stimulus after the BREXIT vote. More recent projections for a U.S. interest rate increase in July were postponed. Bonds continued to provide diversification and yielded positive total returns for the first half of the year. Although historically low fixed income rates continue to make bonds look less attractive, we still recommend clients participate in the asset class for diversification and some income.

Alternative investments which include REITs, commodities and oil and master limited partnerships, continued to perform strongly.

As we move into the third quarter, U.S. markets continue to push higher and record closes seem to happen daily. Upbeat economic data has helped bolster markets and has reinforced investors desire to participate in U.S. markets. As second quarter earnings reports continue to be released, these new market highs will be tested. We continue to stress that clients should not get over confident as we see further volatility in the upcoming months. The U.S Presidential election is one event that may lead that volatility.

Developed international markets have also shown resiliency since BREXIT, with most having positive single digit returns for the year. The newly named prime minister, Theresa May, will lead Britain’s future as they exit the European Union. In addition, Italy will be hosting its own referendum concerning how it’s government will be positioned for the future. Any significant surprises could impact the European marketplace.

Emerging markets have benefited from the extension of low U.S. interest rates, a firming in the price of oil, and the perception of stability in China. That trend is expected to continue.

We continue to be your partners in navigating the future twists and turns of the global markets.

Resources: Morningstar, WSJ, Google Finance, Fidelity, DFA