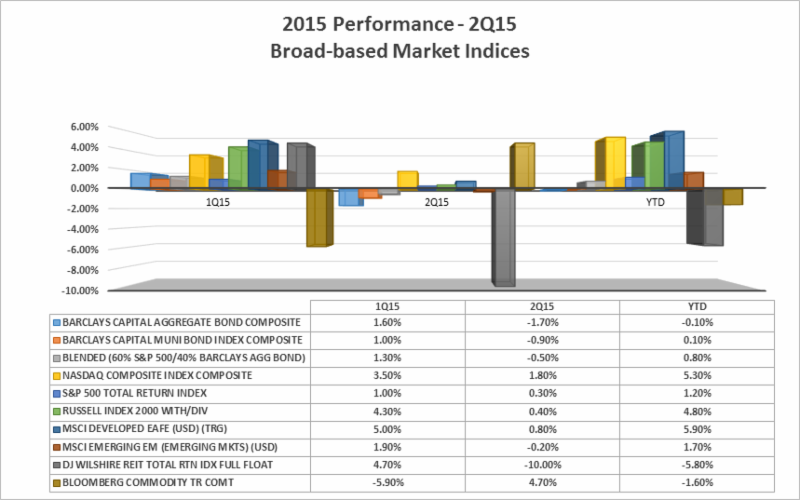

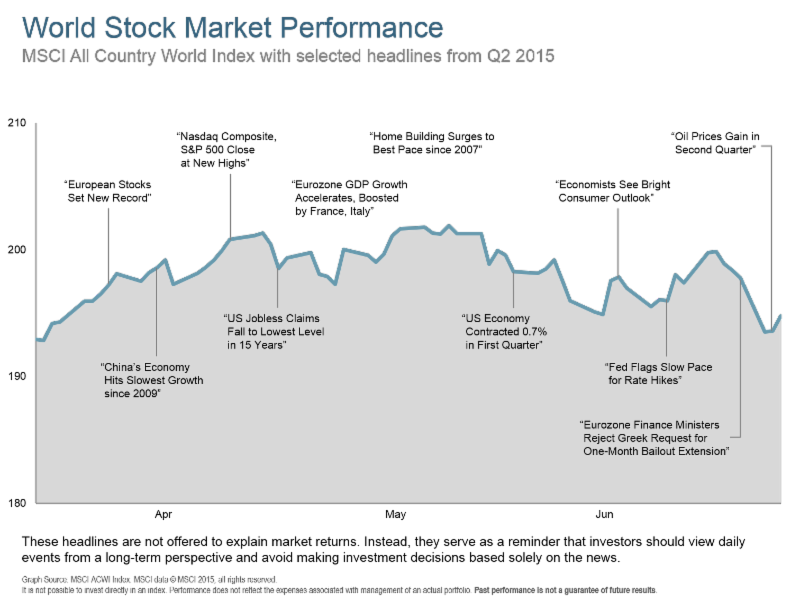

If you fell asleep on 3-31-15 and woke up on 6-30-15, you would have missed some significant world events, yet little changed in returns across most markets with slightly negative results for investments related to bonds, commodities, or holdings sensitive to rising interest rates. How we got to the same start was a different story. Stock market volatility continued as illustrated by selected Q2 headlines in the chart below and the high’s reached early on were erased, yet still positive, over fears of a Greek default and exit from the Euro. Experts expect continued modest improvement in the global economy, led by developed markets with Europe’s emergence from the recession still intact. On the fixed income side of the portfolio, U.S. bond returns were slightly negative for the quarter in anticipation of rising rates. The Fed claims to be still on track for a delayed 2015 rate hike at an expected gradual pace, while other central banks are still in an easing phase, producing positive returns for international developed country bond markets. Recent events suggest that the balance of 2015 will not lack market movements and the trend of volatility will continue, making a diversified approach the best way to shield from any unexpected events.

At the writing of this commentary, global equity markets have stabilized and have risen back towards high’s recently reached in the beginning of the second quarter. Most experts agree that slow and modest growth in the U.S. and globally will keep annual returns in the low single digit category for the year. Several economists have referred to U.S. markets as having entered a more mature phase of the economic cycle with valuations at appropriate levels. A mature cycle can endure for some time (years) and we are comfortable with the continuing expansion, albeit much slower than the preceding 5 years. Preferred, value style stocks have underperformed growth styles in general. International developed stock markets–Europe, Japan, and Australia are at various beginning-to-mid stages of recovery–with attractive valuations. We are currently emphasizing developed international equities for clients’ portfolios as a result of the metrics mentioned.

China, part of the emerging markets, has been in the news quite a bit over the last several weeks, with headlines of a stock market bubble crash. The Chinese government is experiencing growing pains to a more open economy, as they attempt to control and outlaw the market’s quick and veracious decline. At this time, U.S. investors have not been as affected due to the exclusion of outside investors to the Shenzhen and Shanghai markets (termed as “A” shares). We continue to monitor the evolution for any spillover effects into emerging market investments held, and may find this asset class attractive in the near future.

The Fed has continued to repeat that an interest rate hike is on pace to happen this year for the first time since 2006. According to The Fed, just how much the interest rate increases will depend on economic data such as wage growth, job growth and inflation measurements to be released. We continue to keep maturities on bonds in the short to mid maturity range in anticipation of the hike, and hope to take advantage of higher rates when actually available. We have also lightened exposure to riskier bonds over the last six months, anticipating possible liquidity bottlenecks when the Fed finally does act.

We will continue to position our clients’ portfolios with consideration of various market and economic risks. Our goal is to maintain a diversified model to meet each customized portfolio, keeping your current and long-term goals in mind. As always, we are here to assist you, and are happy to address any questions or concerns.