There are many years that investors easily forget, but 2020 is not one of those years. As two thousand and twenty came to a close, the stock market ended much as it began, in a bull market posting all-time highs. With the S&P 500 surging almost 65% since its March low, many people question if there is a disconnect. How could equity markets recover and reach new highs when economic news remains so bleak? This is not all together unusual. Past bull markets, including the one that began in March 2009, have started while the U.S. economy is still in a recession. The market is not always tied to economic performance. Market behavior suggests that investors were looking past the short-term impact of the pandemic. The stock market is always looking ahead, incorporating current news and future expectations into stock prices. Despite unexpected shocks early in the year, people were resilient. Accommodative monetary policy added liquidity to the market and people’s ability to adapt perpetuated hope during a year of change.

Q4 Overview

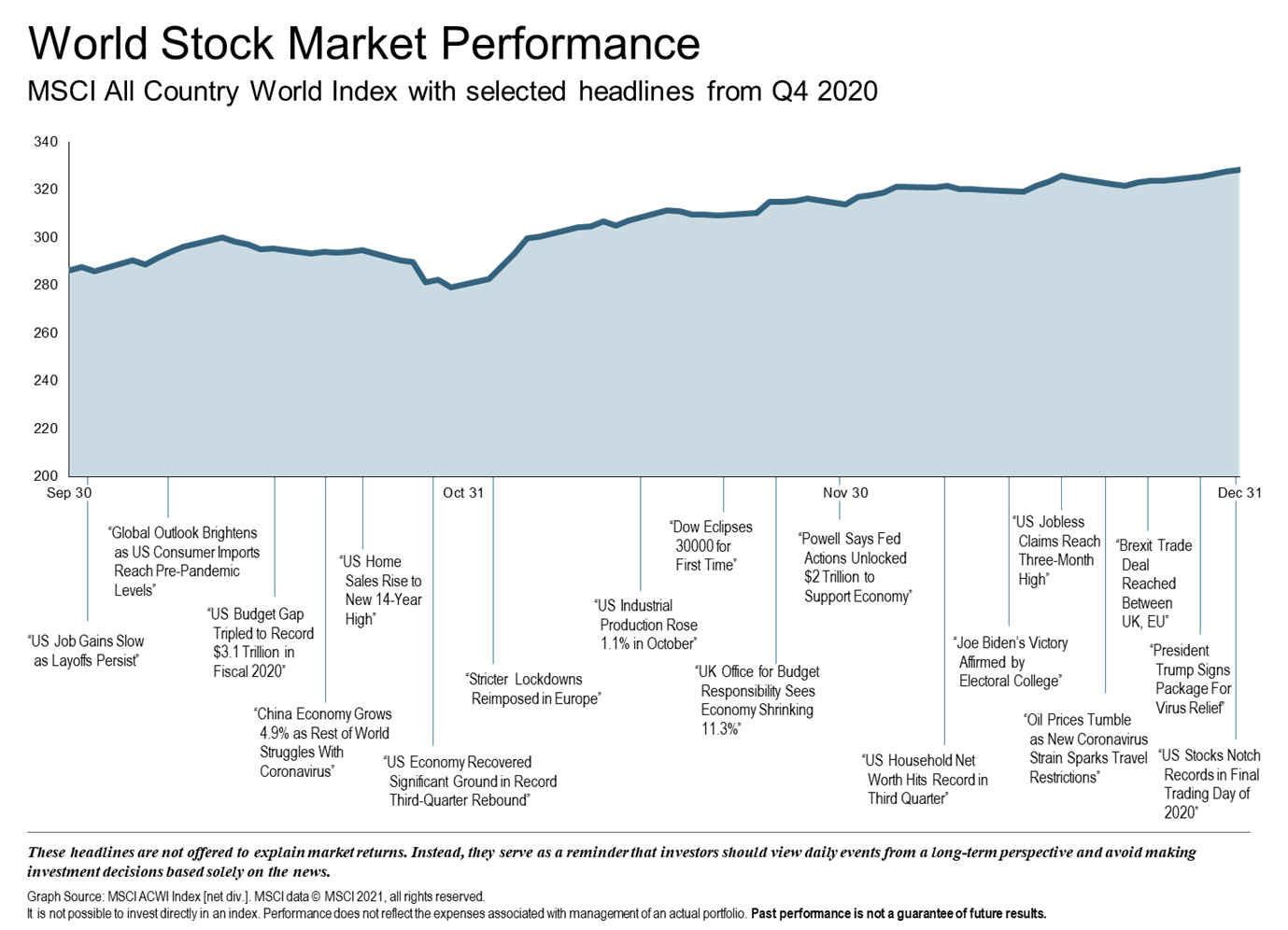

The fourth quarter of this most unpredictable year ended with the Dow surpassing 30,000 for the first time, U.S. jobless claims reaching a 3-month high, and U.S. stocks setting records during the final days of trading in 2020. Almost all asset classes posted positive returns for Q4. A reflationary outlook spurred a shift, with U.S small cap stocks and value leading in performance and emerging markets outperforming non-U.S. developed markets and U.S. equities. Positive vaccine news gave investors hope for economic reopening and, although very contentious, the presidential election resulted in little market reaction.

Global Economy

Most countries continue to recover as vaccine-related opening occurs. China’s economy remains ahead of the rest of the world due to earlier emergence from lockdown. Monetary policy has remained extraordinarily supportive of liquidity and financial conditions. The European Central Bank has increased the size of its planned asset purchases helping to keep bond yields down and the European Union, providing ratification by the 27-member state’s national parliaments, has unblocked a $1.8 trillion financial support package.

- China’s economic recovery is supported by strength in manufacturing.

- Central Banks have injected $8 trillion into economy in 2020.

- Europe implemented lockdowns in Q4. Virus cases have dropped, and the number of new cases remain below the number in U.S.

- Fiscal policy likely to become more stimulative and supportive of inflation.

U.S. Economy

Higher asset valuations ensued as a result of easy monetary policies and a bullish market. The outcome from Q1&2 fiscal and monetary stimulus resulted in the reversal of certain asset class patterns. During Q4 small cap and value spearheaded market gains. The U.S 10-year Treasury yields rose approximately 20 basis points from .69% in Q3 to .93% and overall, fixed income had mostly positive returns. U.S. Congress approved a $900 billion stimulus package in late December, which should help offset some of the real-term, virus-related weaknesses.

Equity Markets

- S. Small Cap posted positive returns of 22%.

- S. stocks rose by 12%.

- S. growth stocks which have benefited from the shift online due to COVID-19, underperformed after positive vaccine news.

Fixed Income

- High Yield Bonds lead with increase of 6.5%.

- Solid performance for year due to record monetary stimulus in Q1.

Commodities

- All six sectors posted positive gains.

- Grains rose 19% with double-digit returns in energy, base metals, and soft commodities.

- Oil prices rose amid vaccine news.

- Gold, among bottom performer for quarter, but top performer among asset class for 2020.

Looking Forward

Thus far, the market has looked beyond near-term weakness thanks to policy support and vaccine news. As we head into 2021, the U.S. Congress approved stimulus package will extend support measures which should boost consumer spending. Continued potential for volatility could result in more modest returns in 2021. Although a winter virus-related resurgence is possible, a double-dip recession in unlikely.

The new political landscape and the rollout of the COVID-19 vaccine will continue to drive the growth trend into the new year. Some risks include record high infection counts in many countries, the unpredictable nature of the vaccine rollout, deglobalization pressures dampening investment-friendly policies, and potential inflation due to an increase in government spending. Although 2020 was one of the most tumultuous years in modern history, the resilience seen in people, institutions and the financial markets was profound. It is becoming more and more clear that, moving forward, adaptability is going to be a key to success. Changes to how people work and socialize will continue to have significant effects on our lives and the economy. The pandemic has accelerated trends such as work automation and digital technologies and will have a lasting impact on what becomes our new norm. This past year should serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions solely based on news.

A diversified portfolio provides a level of security amongst volatility. At Paradigm Wealth Management, we are here to help you weather the storm and realize your financial goals.

The Paradigm Wealth Management Advisory Team

References: Fidelity Investments, BlackRock, Vanguard, Reuters, DFA