Q2 Overview

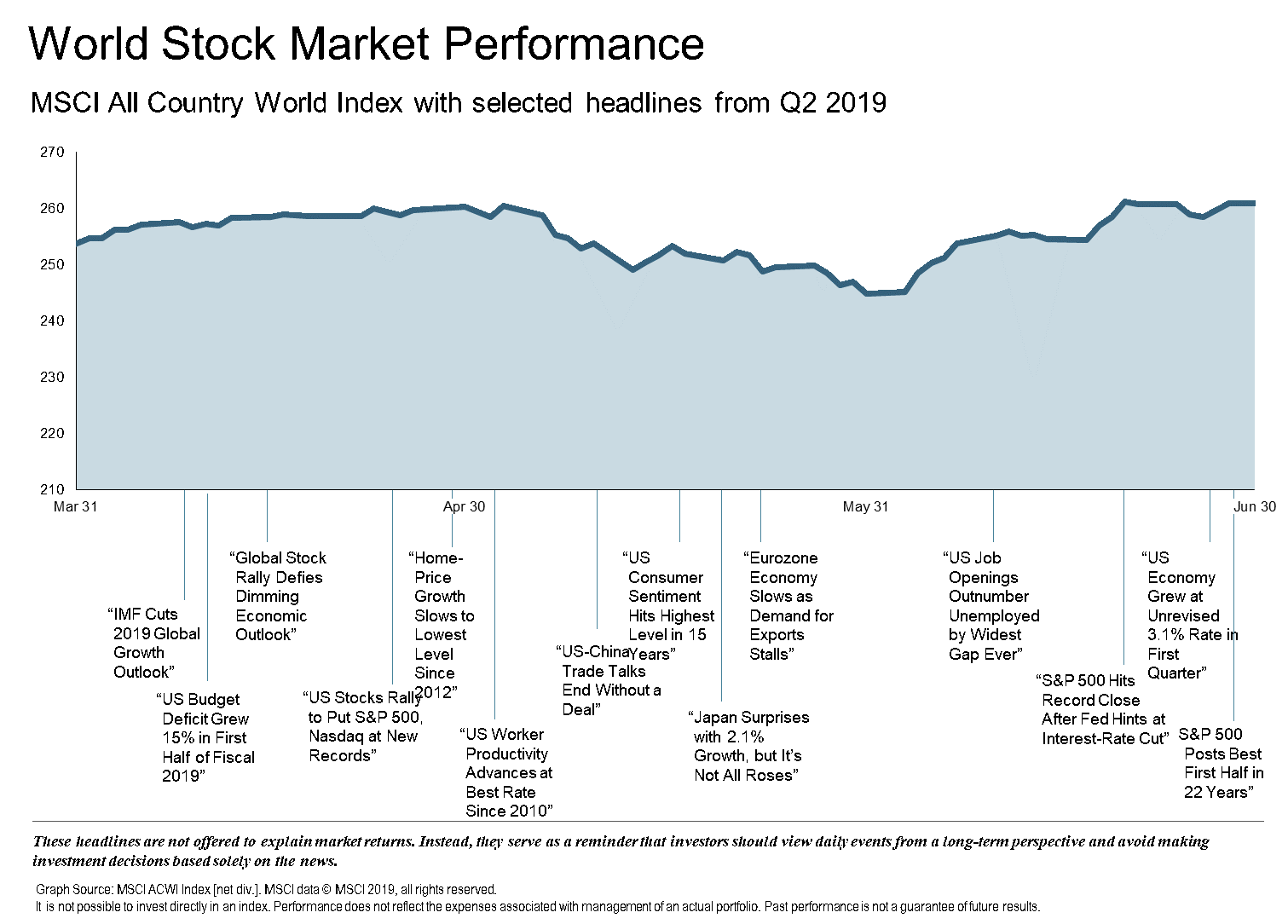

The second quarter of 2019 had some ups and downs as investors viewed global uncertainty as a potential problem during months to come. Fears of a prolonged U.S./China trade war, escalating geopolitical tensions in the Middle East, and slowing global growth all led to investor fear, causing some volatility throughout the quarter. Despite the changing landscape, Q2 closed with U.S. stocks posting new all-time highs, government bonds and gold registering solid returns, and equities and riskier bond categories extending year-to-date gains while bond yields continued to decline and commodities and emerging markets lagged.

Although the U.S. appears to be firmly in the late-cycle phase, the prognosis for a near-term recession is low. After hinting at future interest rate increases at the end of 2018, the Federal Reserve began an about-face and indicated that they may lower interest rates in the months to come while world central banks have taken a similar stance. This shift in tone had a favorable effect on markets, but it is important to note that the global short-term interest rates are higher than two years ago.

Typical of a late business cycle, U.S. earnings growth has decelerated in Q2 after receiving a boost from corporate tax cuts in 2018. Global growth momentum has continued to slow, weighed down by a manufacturing slowdown and trade-policy friction. Historically, late-cycles have had the most mixed performance of any business cycle phase. It is not uncommon to see performance among asset classes less correlated as compared with mid-cycle results.

- Policy stimulus in China has stabilized that country’s growth trajectory for now

- The world’s major central banks, including the Federal Reserve, shifted their tone toward an easing bias. A U.S. rate cut is expected by markets as early as the end of July

- Trade-policy uncertainty is an ongoing drag on corporate confidence and forecasted earning

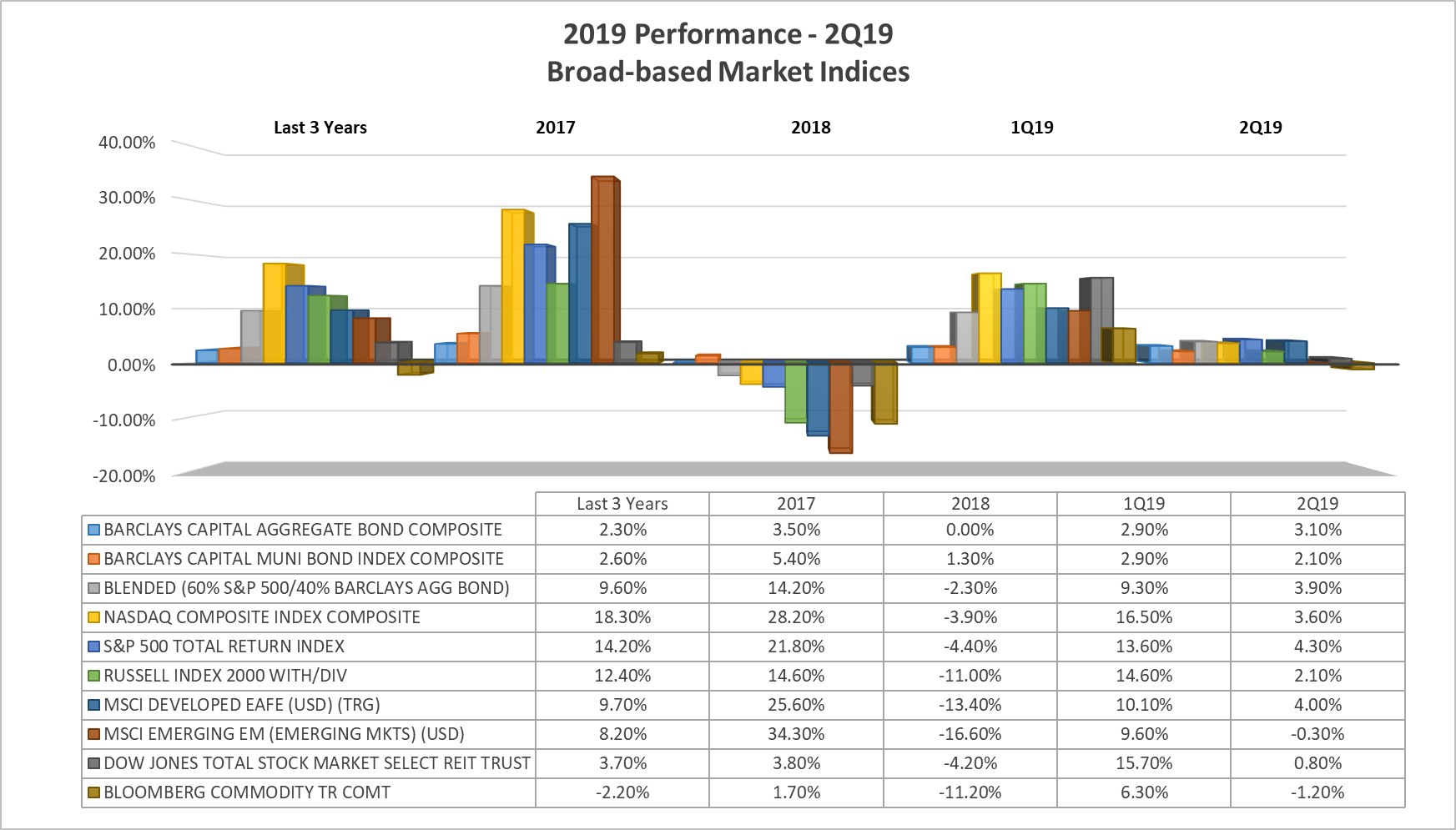

- U.S. equities outperformed non-U.S. developed and emerging markets during Q2

- Small caps underperformed large caps in U.S.

- Value stocks beat growth stocks in emerging markets but underperformed in developed markets

- Ten-year bond yields ended the quarter below 3-month treasuries, inverting the yield curve

- Short-term corporate bond returns increased by 2.09% while intermediate-term corporate bonds had a total return of 3.13%

- Global fixed-income – longer-term bonds generally outperformed shorter-term bonds in global developments

- Commodities lagged with the Bloomberg Commodity Index Table Return declining 1.19% during the quarter

- Corn and wheat led performance returning 14.24% and 13.36% respectively

- Natural gas and cotton were the worst performers

As we continue to move into the third quarter, all eyes will be on the Fed as we wait to see if their recent dovish tone leads to lower policy interest rates. Additionally, it appears that the ongoing trade war with China, coupled with tensions between the U.S. and Iran, will continue to impact the global economy. Although a recession does not appear to be imminent, we remain cautious as we begin to see a downturn in business confidence. In addition to the existing diversification within portfolios, we continue to favor some strategies specific to late-cycle periods. Defensive industry sectors such healthcare as well as companies with low levels of debt and a history of consistent earnings in slow-growth periods are being emphasized. Government bonds are also highlighted in the fixed income portion of portfolios to buffer against anticipated volatility with decelerating global growth and for the appreciation expected from interest rate cuts.

Paradigm Wealth Management continually strives to meet the needs and exceed the expectations of our clients. We appreciate the confidence you place in us and encourage open communication and dialog as we navigate the ever-changing investment landscape in the months ahead.

The Paradigm Wealth Management Advisory Team