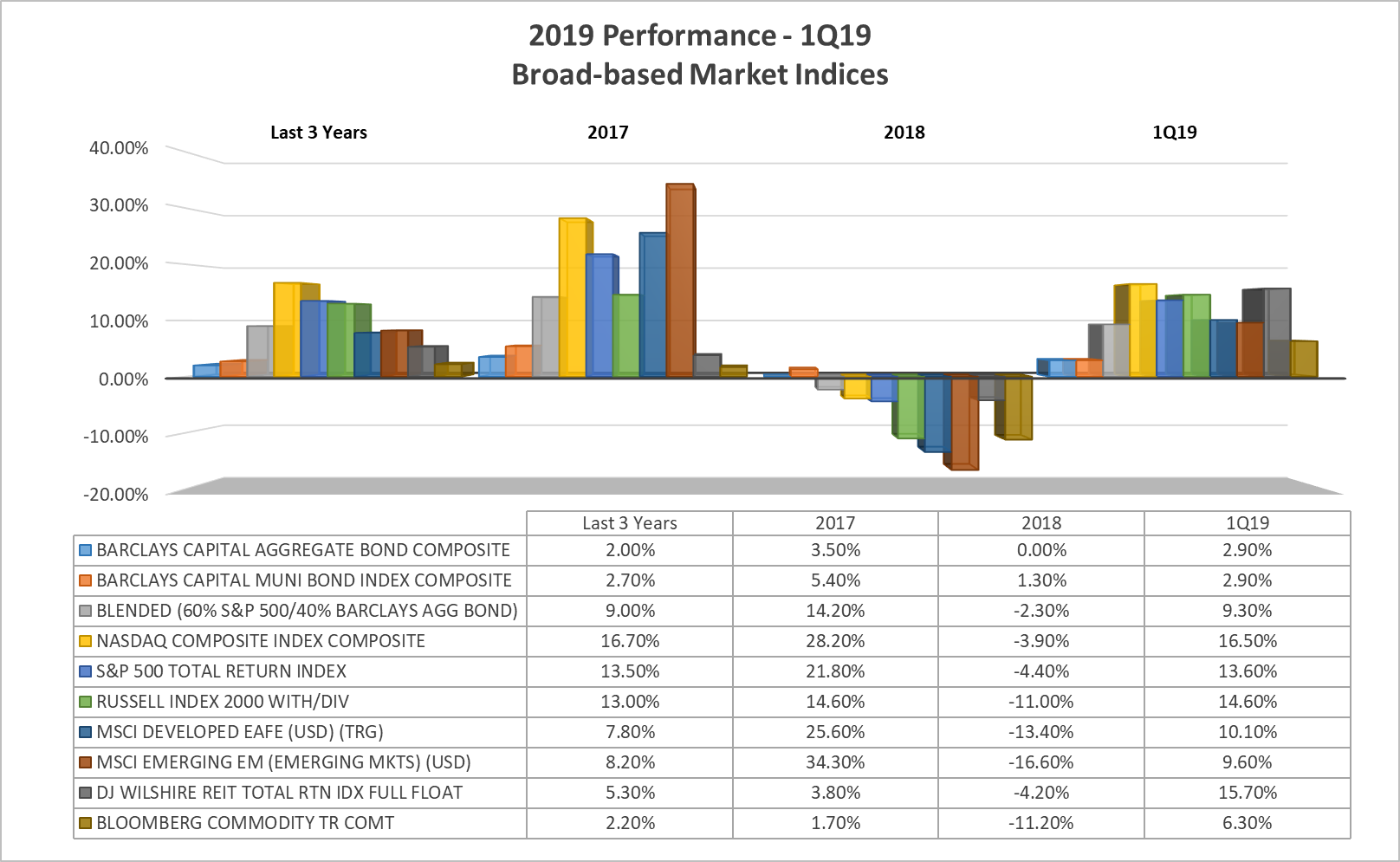

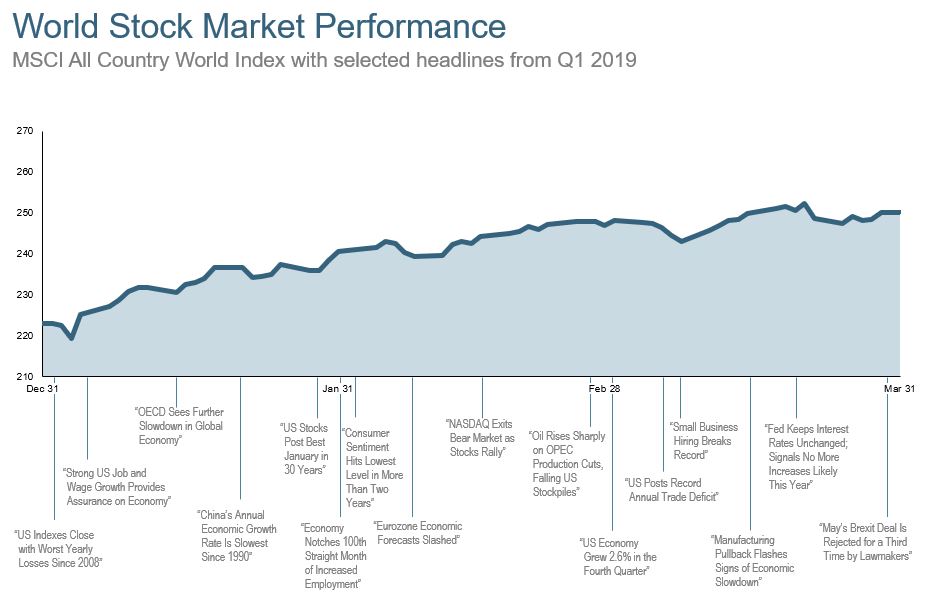

After a significant correction during the fourth quarter of 2018, global stocks have rebounded in the new year. Nearly all asset classes saw positive returns including: US and international equities, bonds and commodities. The correction was fueled by three primary fears: trade war, rising interest rates, and slowing earnings growth. Thus far in 2019, those fears have regressed as the Fed has changed course, progress has been made toward a trade agreement with China, and earnings results have been adequate.

U.S. Stocks, up 14%,had their largest quarterly gain in nearly a decade. Investors’ perception of a looming recession changed dramatically as voting Fed members conveyed that interest rate policy would remain “patient and flexible” as opposed to on autopilot. Developed international and emerging market equities also followed suit in trending higher although, more cautiously amid negative growth in Germany, negligible growth in Japan and a slowing China. Despite the threat of populist government policies and an uncertain BREXIT deadline concerning investors, major indexes recovered most of the losses suffered in the final months of 2018.

Fixed Income markets also posted positive returns for the quarter with prices rising and yields declining. Every segment increased, with the riskier sectors rising the most. The Fed’s March meeting announcement confirmed what had been hinted in January, with little inflation evident, interest rates were very unlikely to rise in 2019. The US 10yr Treasury ended the quarter at 2.42%, well below its year-end high of 2.685%, and fall 2018 peak of 3.24%. In addition to the Fed’s change of course, other world central banks followed suit by extending the timeline for rate increases. China began stimulating their economy with fiscal and monetary measures after a series of declining growth numbers and disappointing industrial production data. During Q1, the 10-year treasury bond yields fell below 3-month treasuries, inverting the yield curve. Historically, curve inversions have preceded economic recessions, although it is important to point out a few key facts. The inversion was short-lived, as it is not inverted as this is being written. Secondly, while various parts of the yield curve have inverted, other important curves have not. The 10-year/2-year treasury curve remained positive. In addition, yield curve inversions lack perfect forecasting as they have predicted seven of the past nine recessions, which means there were two false signals.

Alternative Income investments moved higher with oil increasing 30% for the quarter. In addition to the positive effects of interest rate policy changes, OPEC production cuts and supply disruptions, added to the pricing strength. REITS did particularly well given their sensitivity to interest rates and the multi-asset sector also recovered from year-end declines.

Looking back, there is now consensus that December’s drawdown in returns were a mini bear correction and not the start of a much deeper market retreat. Investor sentiment changed as the US Fed communicated that it plans to remain extremely dovish in coming months. Valuations are now considered more reflective of a slower (not negative) world growth scenario with little inflation expected. Most experts see very few, if any, signs of recession in the near-term or an abrupt end to one of the longest economic expansions on record. Yet, most stipulate we are in a mature phase of the current economic cycle and the pace of investment returns experienced in Q1 will be tough to replicate. Key to current growth projections will be a continuance of current monetary accommodation by world banks, inflation remaining subdued, containment of trade disputes, and a stable growth trajectory in China.

Although portfolio diversification is always the first line of defense, Paradigm will be implementing additional strategies specific to this late-cycle period. Equities have performed well in similar stages and the US remains our highest conviction for stocks, with industry sectors, such as healthcare and technology, that can sustain earnings growth in a slowing economy. Within the international equity allocation of portfolios, we prefer emerging markets, due to stimulus policies in China, growing adoption of Chinese stocks into key equity indexes, and an overall improvement in earnings.

A slow but still growing global economy is typically favorable for fixed income markets as well. It is believed that the inverse relationship between US equity and government bonds can reduce volatility. We will be adding US Treasuries as a buffer for any forthcoming periods of volatility. Not only do US government bonds typically counter a falling stock market, but after 3 years of rate hikes, they provide reasonable income.

During this relatively calm period, it’s important to point out that market corrections are inevitable, and one will occur again. At Paradigm, we believe that the key to long-term success is a steady hand. Our goal is to make sure that the assets in your portfolio will help to fulfill your financial goals while ensuring that your exposure to risk matches your ability to tolerate it. As always, we look forward to having individual discussions with you in the coming months about our views and how they impact your financial plans and portfolio.

The Paradigm Wealth Management Advisory Team

References: WSJ, DFA, Fidelity, PIMCO, Blackrock, CIBC, Neuberger, Arkadios Capital